🗞️Last week, markets basically voted for a soft landing before the data has actually confirmed it:

Equities surged — S&P 500 up ~3.5% and Nasdaq over 4.5% on AI and tech strength.

Rate-cut expectations firmed as the Fed highlighted labour-market risks, keeping a December cut alive despite data delays..

Europe is disinflating, not collapsing — eurozone inflation near 2.1% and German HICP at 2.6%, keeping the ECB cautious.

Japan edged toward tightening with Tokyo CPI at 2.8%, though growth and consumption remain fragile.

Political noise stayed contained — Trump’s Ukraine stance and UK fiscal concerns made headlines but didn’t derail the broader risk rally.

📝This sets the stage for a data-heavy 1st–5th Dec week: ISM manufacturing (Mon), eurozone CPI & unemployment (Tue), ADP & ISM services (Wed), jobless claims (Thu), then PCE Price Index and UoM sentiment & Inflation Expectations on Friday.

That incoming data will either validate the rally… or pull the rug.

From here, each asset is basically a different lens on the same story.

🇪🇺EURUSD – Between a Softer Dollar and “Not-Quite-Done” European Inflation

Last week:

EURUSD traded like a tug-of-war between a softer, rate-cut-priced dollar and an ECB that’s not ready to declare victory on inflation. Eurozone headline inflation is sitting near 2.1% with core around 2.4%, while German HICP at 2.6% shows domestic prices are still sticky.

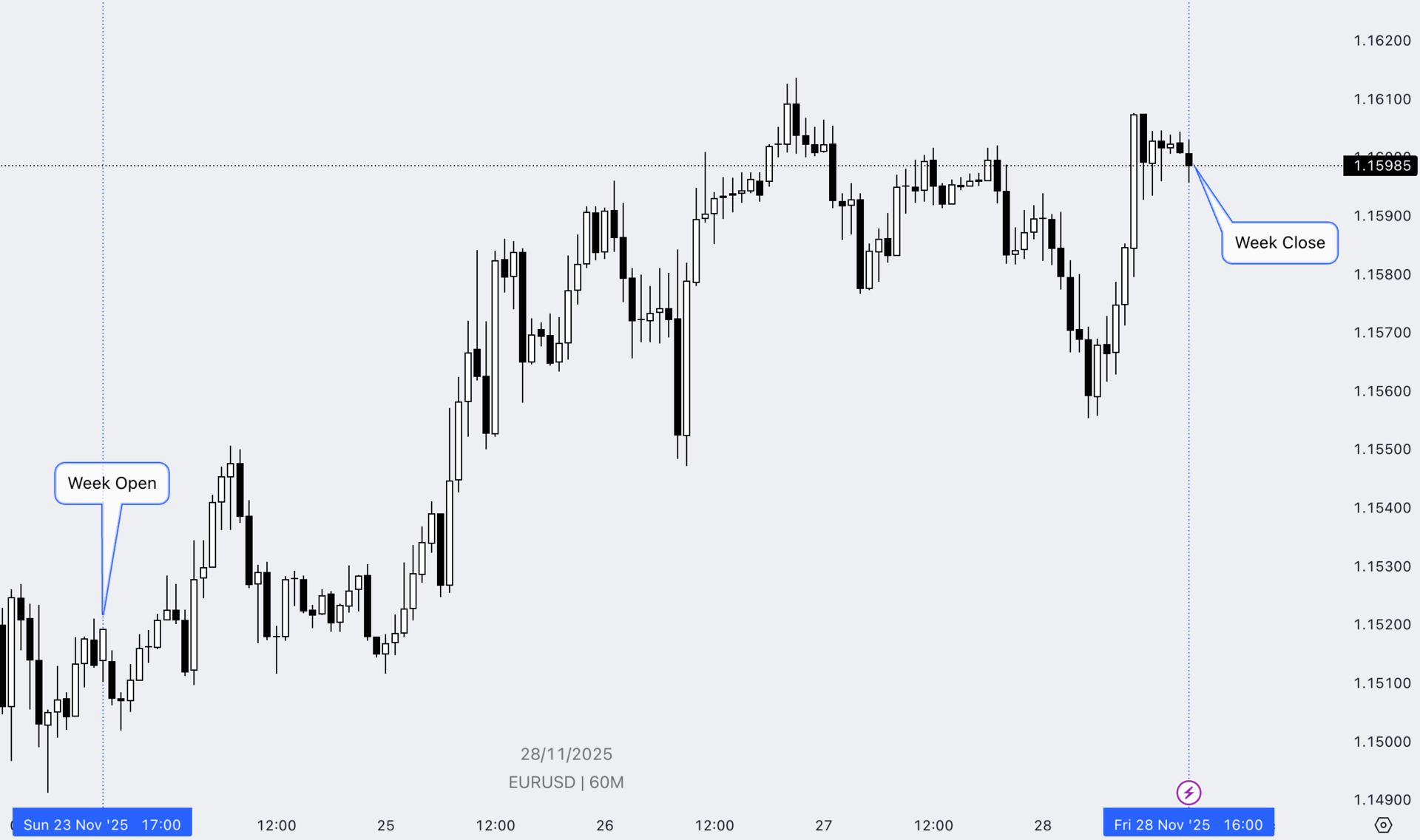

EURUSD Weekly Projection on the Hourly Chart

That mix kept EURUSD supported on dips but capped on the topside: the euro can breathe, but it doesn’t have a runaway growth or policy story behind it.

This week:

EURUSD is the purest expression of “who blinks first?” on data:

Euro side: Flash November CPI and unemployment hit on Tuesday. A hotter print or strong labour backdrop would argue against further ECB cuts and back a more durable EUR rebound.

US side: ISM manufacturing (Mon), ADP/ISM services (Wed) and Friday’s PCE Price Index will show whether the labour market is just cooling… or cracking.

🗝️If euro inflation holds firm while US data disappoints, the story becomes “ECB on hold vs. Fed cutting into weakness” — bullish EURUSD.

If euro data softens and US numbers beat, the dollar’s reprieve continues and EURUSD remains a range-trade rather than a breakout.

🇯🇵USDJPY – A Carry Trade That’s Starting to Look Over Its Shoulder

Last week:

The yen spent the week caught between carry-trade reality and BoJ rhetoric.