🗞️Markets opened the week navigating a mix of softening global data and rising geopolitical tension:

Economic signals turned mixed — global PMIs and US labour figures hinted at cooling momentum, fuelling speculation that the Fed may move ahead with a December rate cut 💹.

Europe stole headlines with the EU rolling out a major plan to reduce reliance on Chinese critical materials, underscoring a broader shift toward supply-chain de-risking ♨️.

Geopolitics stayed hot — Putin’s visit to India, Macron’s strategic outreach to Beijing, and the renewed push for an Ukraine peace deal all fed into a more uncertain global backdrop 🌐.

Risk sentiment remained fragile — with growth expectations easing, markets increasingly leaned on yields, Fed tone, and cross-asset flows to find direction 🎙️.

📝In short: macro signals softened, geopolitics tightened, and markets traded cautiously, waiting for clearer catalysts.

With fundamentals offering noise but no decisive trend, we return to what has guided us all year: price action. This week, we’re checking in with the levels outlined in Sunday’s Technical Outlook — and so far, price has respected our key zones almost perfectly. Let’s walk through each pair and see how the market has reacted relative to our Sunday map.

📈Lets Dive into the charts!

🇪🇺 EURUSD

EURUSD Daily Chart

EURUSD continues to follow our Sunday roadmap, breaking key levels and maintaining bullish momentum.

Price has closed above the Daily OB, confirming our bullish bias.

Structure remains clean after last week’s reaction from the Daily FVG.

The next draw on liquidity sits at 1.17280, then 1.19200 if momentum extends.

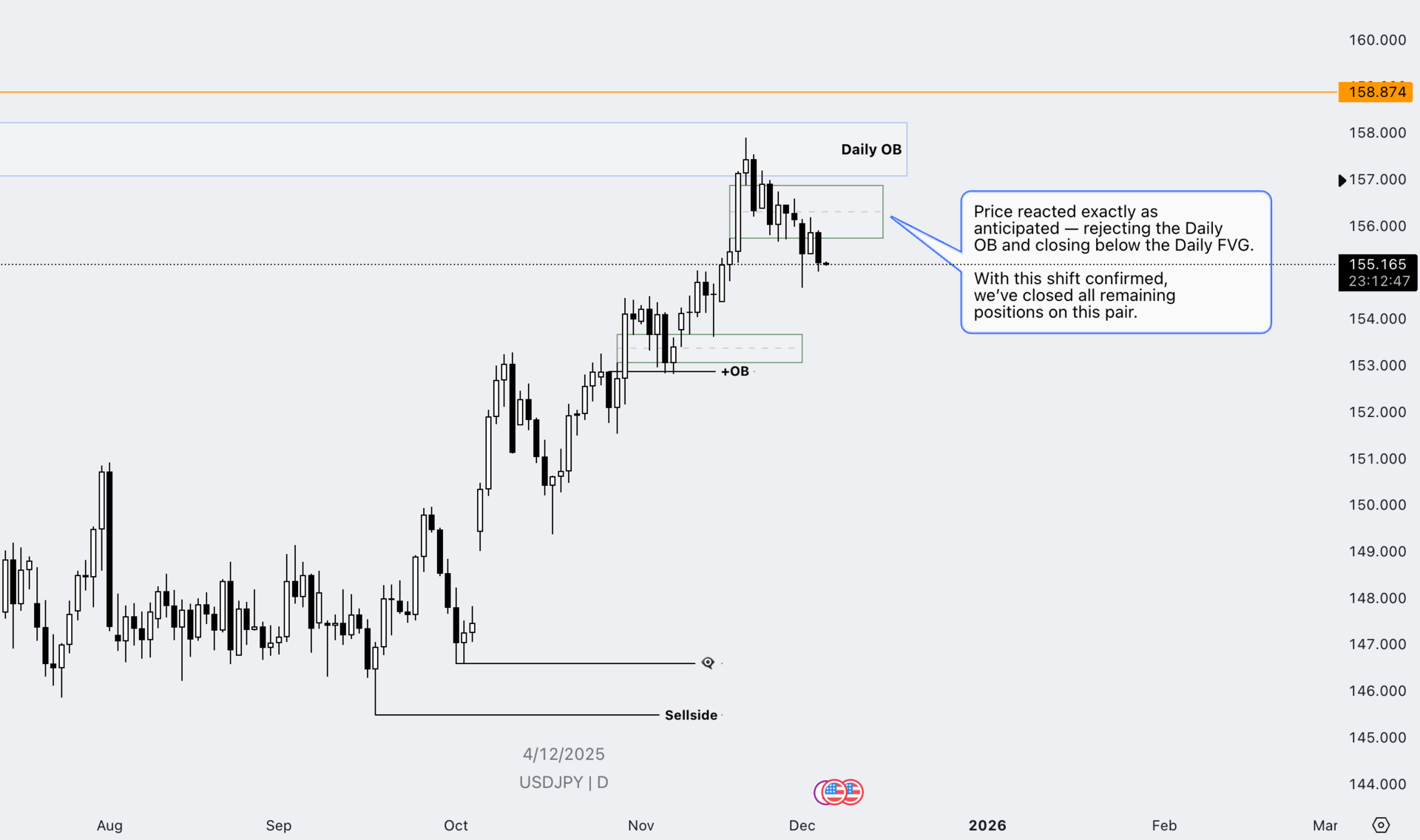

🇯🇵 USDJPY

USDJPY Daily Chart

USDJPY played out our Sunday roadmap perfectly, reacting cleanly from the levels we highlighted.

Price rejected the Daily OB exactly as anticipated.

The session closed below the Daily FVG, confirming a shift in momentum.

With this confirmation, we’ve closed all remaining positions on this pair.

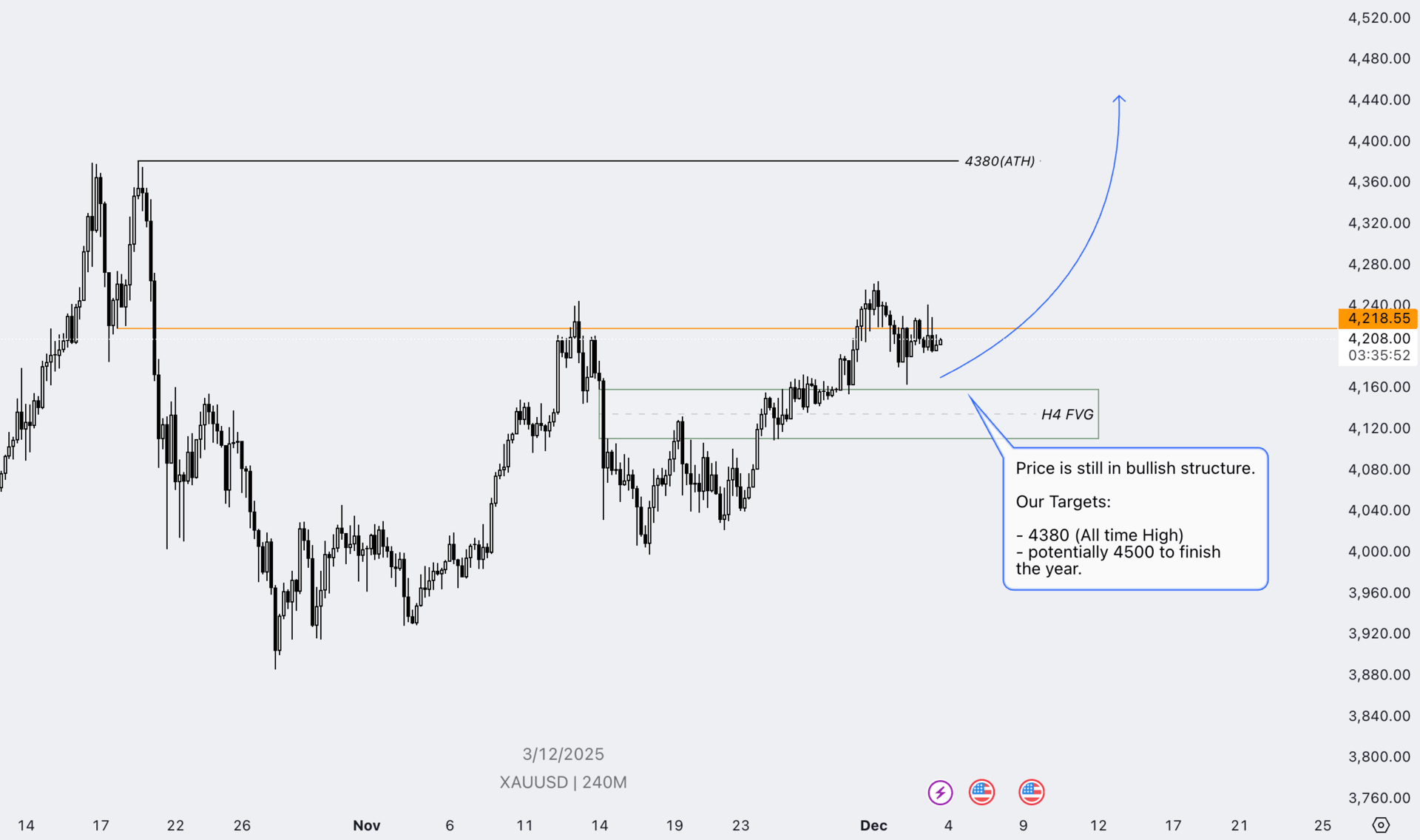

🟨XAUUSD (GOLD)

XAUUSD H4 Chart

Gold continues to hold its bullish structure, staying aligned with our Sunday outlook.

Price is respecting the H4 FVG, maintaining upward momentum.

Structure remains firmly bullish unless this zone is broken.

Our next draws are 4380 (ATH), with a possible extension toward 4500 into year-end.

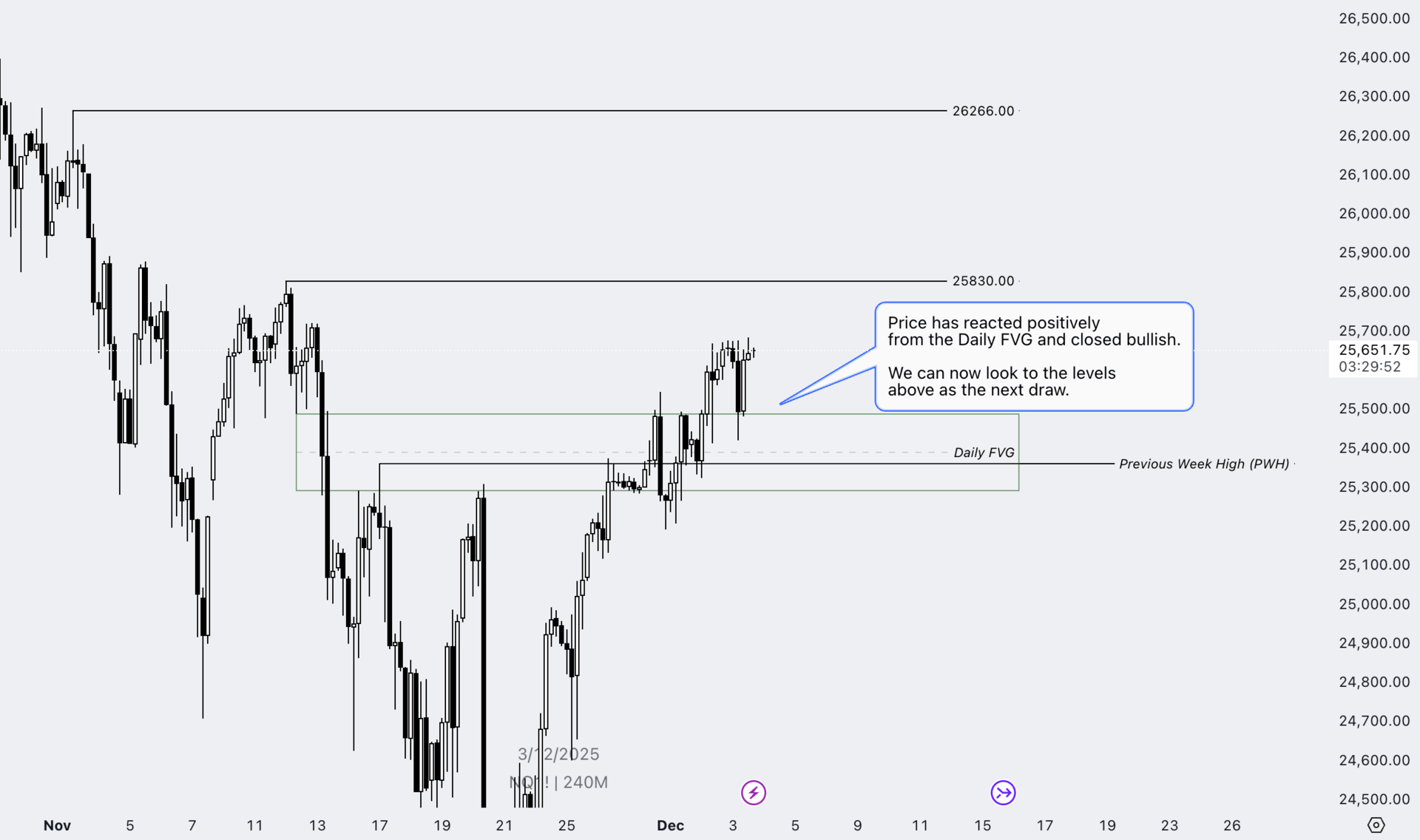

📈Nasdaq(NQ) Futures

NQ Futures H4 Chart

NQ continues to respect structure, reacting cleanly from the levels we outlined on Sunday.

Price rejected the Daily FVG and closed strongly bullish.

Momentum remains intact as long as price holds above this zone.

The next upside draws sit at 25,830, followed by 26,266 if strength continues.

🧩Final Word

This week’s price action has largely respected the structure we mapped out on Sunday, reinforcing the value of letting levels — not noise — guide our decisions. As we move through the rest of the week, stay patient, stay selective, and let the market reveal its hand before you commit.

The market moves in its own time — your job is simply to be prepared when it does.

Stay safe and happy trading!

— UE Market Letter Team 👁️🗨️

© 2025 UE Market Letter. All rights reserved.

The information shared in the UE Market Letter is intended solely for educational and informational purposes. It should not be interpreted as financial, investment, or trading advice. All views expressed reflect the author’s personal analysis and opinions and are not recommendations to buy, sell, or hold any financial instrument. Trading and investing carry inherent risks and may not be suitable for every investor. Market performance is uncertain — past results do not guarantee future outcomes. Readers are encouraged to conduct their own research and seek guidance from a licensed financial advisor before making any investment decisions. UE Market Letter and its authors accept no liability for any loss or damage arising from reliance on the content provided.