Last week the dominant theme was dollar repricing on rising Fed-cut expectations, with that single macro story transmitting through FX: EUR/USD got a lift as the euro caught a softer dollar tailwind and improving European inflation data; USD/JPY oscillated as risk flows and BoJ/FX-monitoring headlines interacted with moves in U.S. yields; the DXY ended the week a touch softer inside a choppy range as markets priced more near-term easing. These moves were amplified by headline risk (tariff/geopolitics) and U.S. data/calendar uncertainty from the government shutdown.

What happened So Far

💲DXY (U.S. Dollar Index) - The engine

The DXY traded in a roughly 98–99 range but showed an overall bias to soften as markets increased the odds of Fed easing. Traders reacted to Fed officials signalling preparedness to cut if growth/labour softens, and to delayed/missing U.S. data because of the shutdown — both factors reduced the near-term dollar bid. Price action was choppy day-to-day but the narrative was one of easing expectations denting the dollar.

DXY H4 (4 hour chart)

🇪🇺EUR/USD - Benefited from dollar repricing + resilient euro fundamentals

EUR/USD rallied at points as the euro picked up the mechanical upside from a softer dollar. That move was not purely risk-on: euro-area inflation ticked up in September (Eurostat reported a 2.2% annual rate), which gives the ECB cover relative to markets that were otherwise pricing aggressive Fed cuts. In short: euro gains were partly dollar-driven and partly supported by firmer euro-area inflation prints.

EURUSD H4 (4 hour chart)

🇯🇵USD/JPY - Two-way, path dependent on yields & headlines

USD/JPY swung widely (intra-week roughly mid-149s to low-152s) as U.S. real yields and risk flows fought for control. When dollar and yields eased on Fed-cut bets and shutdown uncertainty, the yen found support (JPY strengthened). However, safe-haven flows on specific risk spikes and persistent carry/BoJ guidance kept the overall range wide. Japan’s officials also signalled heightened sensitivity to disorderly FX moves — adding a political overlay that capped excess moves.

USDJPY H4 (4 hour chart)

How the pieces fit: The central causal chain last week was: Fed-cut talk & data delays → lower U.S. real yields / softer dollar → EUR/USD higher and USD/JPY pressured. Overlay risks (tariffs, geopolitics, central-bank/official comments) created reversals and the wide intra-week ranges.

🎙️Why these moves were credible (fundamental drivers)

Fed messaging and the economic backdrop: Several Fed speakers leaned toward supporting a near-term cut if the data and inflation trajectory warrant it — that shifted market odds materially and fed dollar weakness. The government shutdown also created data gaps and uncertainty, reducing the information flow that typically props up directional conviction.

Euro-area inflation surprised mildly higher: Eurostat’s September print showed inflation around 2.2% y/y — not runaway, but enough to make markets respect the ECB’s relative position versus the Fed, tempering pure euro weakness. That muted one mechanical source of EUR downside and allowed EUR/USD to capture dollar softness.

Japan’s policy/official window and FX vigilance: Tokyo’s officials publicly warned about excessive FX volatility — that political/official stance acts as a governor on aggressive JPY moves and keeps USD/JPY reactive to headlines rather than free-running on carry alone.

📊What to watch next week (20–24 Oct) - The catalysts that will decide whether the recent moves extend or reverse

Fed speakers & the US data calendar (including delayed CPI): Fed commentary (and the delayed US September CPI due later in the week) is the top market mover. Hawkish surprises (less reason for cuts) would boost the DXY and hurt EUR/USD and gold; dovish confirmation would extend the dollar’s soft patch. Markets are particularly sensitive because missing data earlier means a single CPI print could swing pricing materially.

Euro-zone prints and surveys: Any further upside surprise in euro-area inflation or surprisingly firm PMIs would support the euro against a softening dollar; conversely, weak data would make EUR/USD vulnerable to a renewed leg lower if dollar easing stalls.

Japan/BoJ commentary and FX-official signals: Watch for BoJ speeches and any renewed government/finance ministry comment. Tokyo’s latest public admonitions on volatility make the yen sensitive to both risk sentiment and perceived policy intent; a sharp safe-haven bout could push JPY stronger even if the DXY is softer.

Headline risk (tariffs, geopolitics) and risk appetite: These continue to amplify moves — e.g., a tariff-type shock or a calming headline will have outsized effects on NQ and flows into/out of safe havens (USD/JPY, CHF, gold), which feed back into dollar indices.

📋Short, actionable watchlist

If Fed commentary + CPI point to higher cut probability → expect DXY to drift lower; EUR/USD to extend gains as euro captures dollar weakness. (Bullish EUR/USD narrative validated.)

If CPI surprises hot or Fed pushes back → expect a dollar bounce, EUR/USD reversal, and renewed upside in U.S. yields; that would also push USD/JPY higher via higher yields.

If BoJ / Japan officials intensify FX intervention rhetoric or act → USD/JPY may face asymmetrical downside for the dollar (yen strength), even in a softer-dollar environment.

If geopolitical/tariff headlines flare → short, sharp moves in all three: DXY up (safe-haven dollar), EUR/USD down, USD/JPY down (yen strength via safe-haven flows).

📈NQ Headline: Tech and AI momentum powering gains, but valuation and macro risks loom large

The Nasdaq-100 continued to be driven by strong tech/AI optimism — especially after major companies like Nvidia and ASML reported solid earnings and raised forward guidance, fuelling investor appetite. At the same time, the market is showing signs of caution: valuations are extended, growth stocks are highly sensitive to interest-rate expectations, and macro risks (e.g., delayed data from the U.S. government shutdown) are creating added uncertainty.

The result: while the trend remains upward, the NQ is increasingly vulnerable to any abrupt shift in Fed policy, inflation data or risk sentiment.

Watchlist for the week

U.S. inflation & Fed messaging — The delayed U.S. CPI (scheduled for 24 Oct) and any Fed speakers around 21-22 Oct are key. A hawkish surprise could trigger a sell-off in rate-sensitive tech names, hurting NQ.

Earnings and tech sector guidance — Given that NQ is heavy in mega-cap tech/AI firms, any signs of earnings disappointment, slower AI build-out or margin pressure will matter.

Risk-sentiment & macro shocks — Because the tech rally has been partly momentum-driven, a negative surprise (trade/ tariff escalation, credit worries) could trigger sharper pullbacks. The market’s “good news = bad for yield = good for tech” dynamic is still fragile.

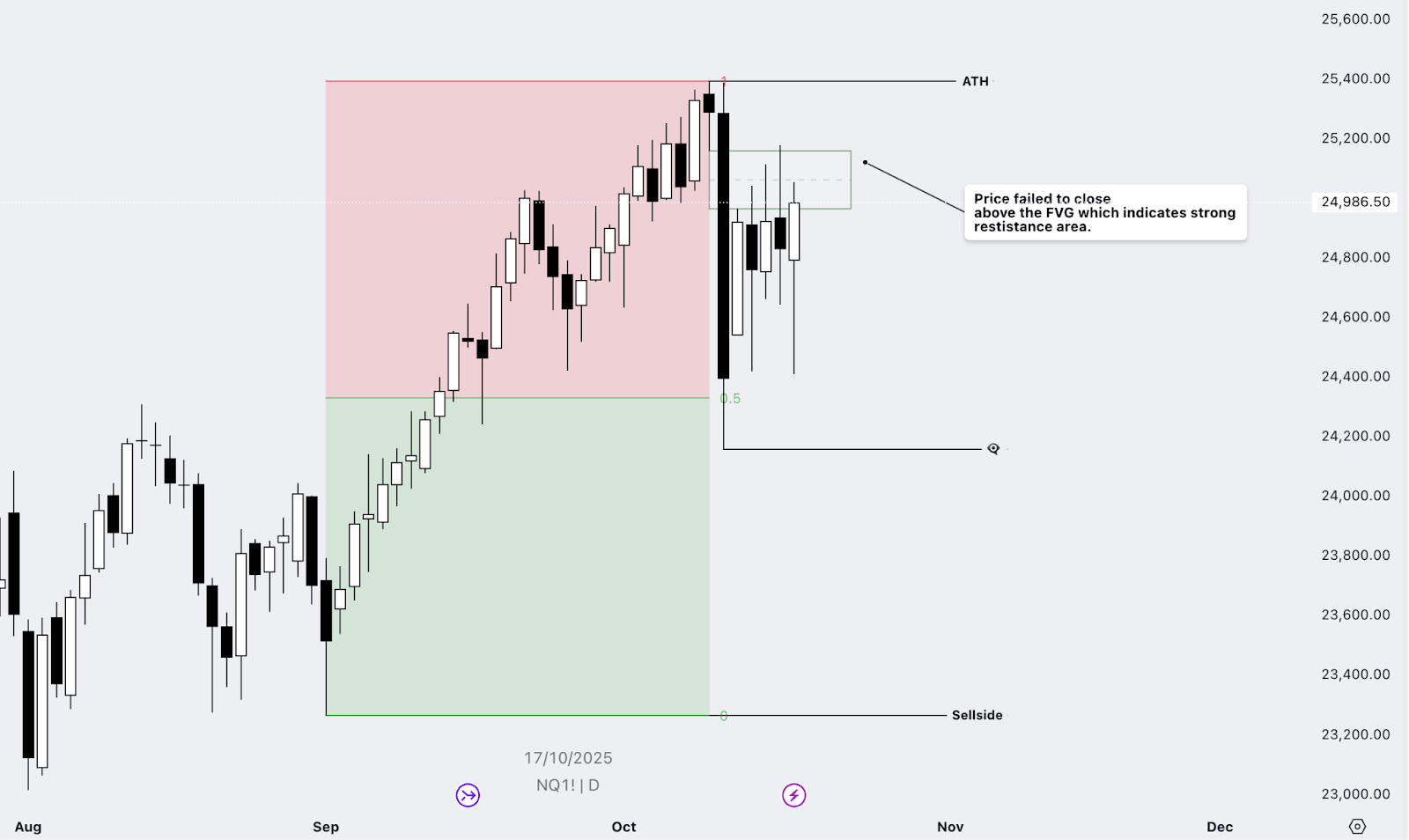

E-mini Nasdaq 100 Futures Daily chart

🧪The Technical Corner

Welcome to the Technical Corner — the part of the letter where we skip the headlines and get straight to the charts.

With the fundamental picture laid out, it’s time to shift gears and see how price is behaving on the charts.This is where we break down the setups that actually matter — no noise, no fluff. Just structure, levels, and opportunities.

We’ll walk through each chart with a simple focus:

Where’s price heading? Where’s the risk? And what’s the play?

Whether it’s a clean breakout, a key retest, or a market that’s begging for a pullback — this is where we line up trades with conviction and clarity.

Let’s pull up the charts and get to work.

🇪🇺EURUSD

EURUSD Daily Chart

On the daily timeframe, EURUSD initially pushed higher but has since shifted firmly into bearish momentum. Last week’s move now appears to have been a corrective retracement, followed by a sharp rejection from the bearish Fair Value Gap (FVG) — reinforcing the downside bias.

That said, price is now approaching a bullish FVG formed last week — a critical zone to monitor for a potential reaction or temporary support. For now, our bias remains bearish as momentum favors sellers.

Let’s zoom in.

EURUSD H4

Even though our bias remains bearish, we’re not married to it. If price shows early signs of strength or a clear reaction from the key H4 bullish FVG (key area), we’ll be watching for potential long opportunities at least toward the 1.17074 resistance area.

Otherwise, our downside targets for the week remain around 1.15500 level and 1.14000 level, aligning with key structure levels and prior liquidity zones.

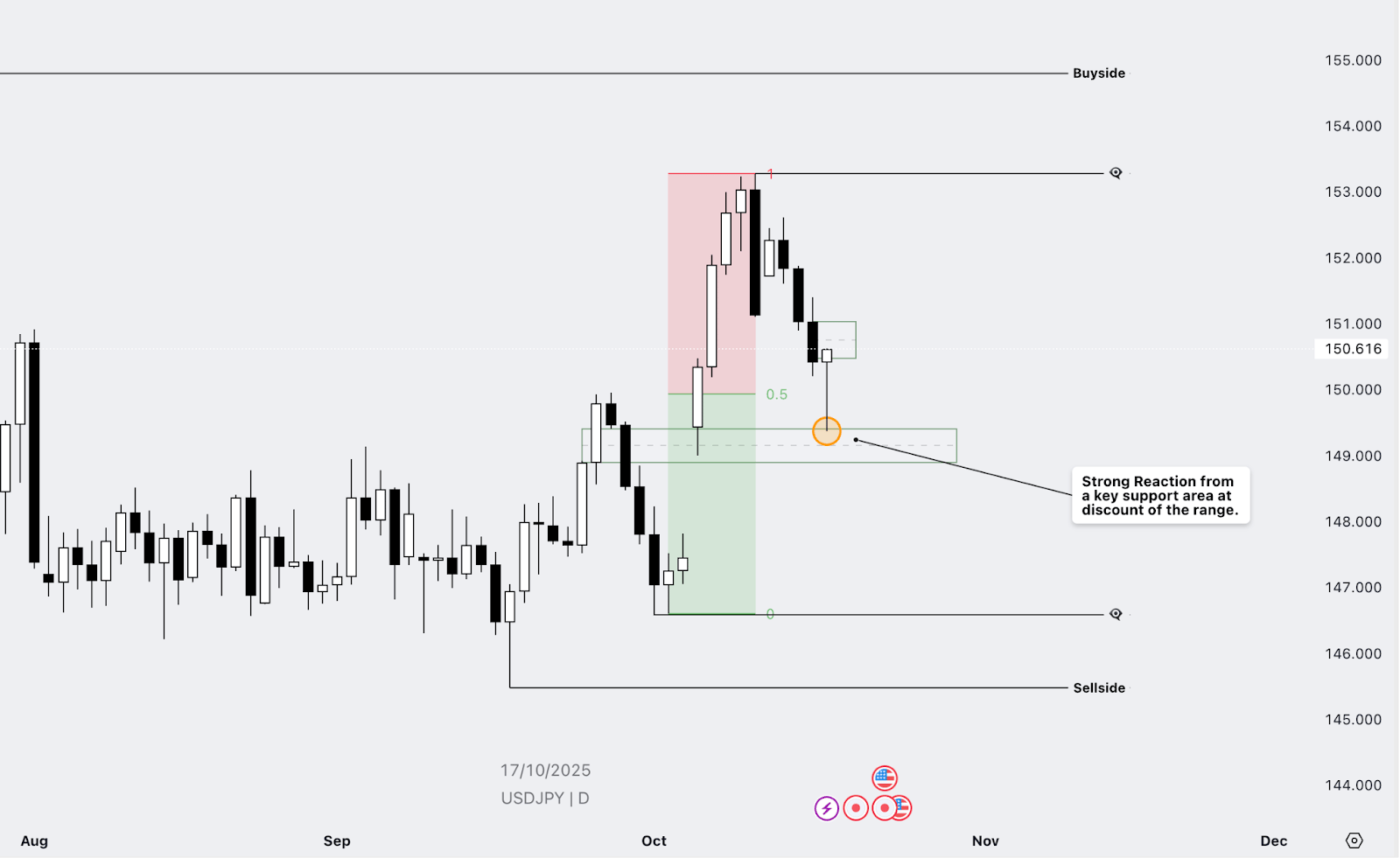

🇯🇵USDJPY

USDJPY Daily Chart

Shifting over to USDJPY, On the daily timeframe, price has shown a strong reaction from a key support area sitting at the discount of the current dealing range.

Price retraced into a prior order block, aligning with the 0.5 Fibonacci retracement level.

A clear rejection occurred at this zone, signaling buying interest.

The move suggests upside toward buyside liquidity resting above short-term highs (153.00–155.00 area.)

Bullish bias remains intact as long as the recent bullish order block + iFVG around 148.50–149.00 holds.

However, a clean break below that zone would invalidate the structure and open the door for a deeper run toward the sellsides below 146.00.

Lets zoom in for clearer visuals!

USDJPY H4

The key area to watch is the bearish FVG. If price manages a strong close above this zone, we could see a push toward the high of the range.

E-mini Nasdaq 100 Futures

Moving to the equities market, The Nasdaq-100 has been leading the charge lately, with AI and mega-cap momentum driving price action. But as always, macro and yield dynamics are lurking in the background.

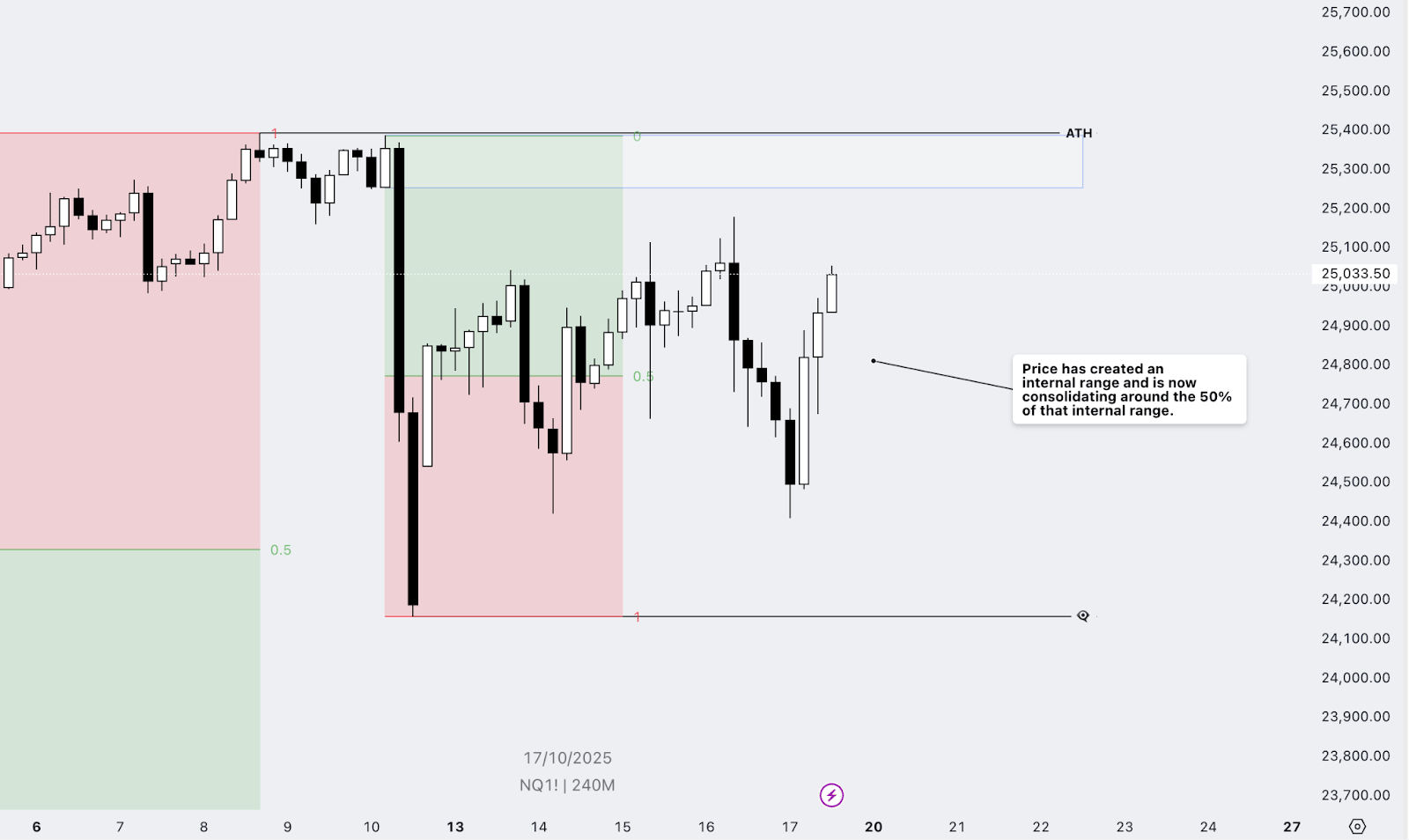

E-mini Nasdaq 100 Futures (H4 chart)

Price is currently consolidating around the 50% level of the current range. While fundamentals remain bullish, the technical picture shows resistance at the H4 bearish FVG created during the flash crash on October 10th, preventing a clear breakout.

Given the indecision, we’ll wait for Monday’s open to reassess and determine the optimal position for the week.

We’ll provide a full update in The Technical Corner on Wednesday at 18:00 EST — make sure you’re subscribed so you don’t miss it!

Final Word

Markets remain in a state of cautious recalibration. EUR/USD is finding support on dollar weakness but remains sensitive to U.S. CPI and Fed messaging. USD/JPY is rangebound but twitchy, with both risk flows and Tokyo’s FX vigilance dictating near-term moves. The DXY is digesting repriced Fed-cut expectations, and any hawkish surprises could trigger a rapid dollar rebound.

On the equities side, the Nasdaq-100 (NQ) continues to ride tech and AI momentum, but stretched valuations and macro uncertainty mean swings can be sharp. The tape is waiting for clear triggers — CPI, Fed commentary, and headline risk — to determine the next leg.

Key takeaway: Maintain a disciplined approach, respect technical zones, and watch macro catalysts closely. Price action will lead the way, but conviction comes from waiting for clarity rather than chasing moves.

Stay Safe and Happy Trading! 👁️🗨️

© 2025 UE Market Letter. All rights reserved.

The information shared in the UE Market Letter is intended solely for educational and informational purposes. It should not be interpreted as financial, investment, or trading advice. All views expressed reflect the author’s personal analysis and opinions and are not recommendations to buy, sell, or hold any financial instrument. Trading and investing carry inherent risks and may not be suitable for every investor. Market performance is uncertain — past results do not guarantee future outcomes. Readers are encouraged to conduct their own research and seek guidance from a licensed financial advisor before making any investment decisions. UE Market Letter and its authors accept no liability for any loss or damage arising from reliance on the content provided.