📰Last week reminded markets that fundamentals are no longer just about data — they’re increasingly about geopolitics, strategic rivalry, and how governments choose to shape global trade. From Europe’s push to secure supply chains, to Macron’s confrontational diplomacy in China, to U.S. yields adjusting around growth expectations, the macro narrative fed directly into FX, metals, and equities.

🔗Let’s connect the dots and see what this means as we head into the new trading week.

🇪🇺EURUSD — Europe Finds Its Voice, but Growth Still Lags

Last week:

Europe dominated headlines with its biggest economic-security push in years: new EU measures to cut dependence on Chinese critical materials, and Macron pressuring Xi on China’s trade surplus. This showed a Europe trying to reassert economic control but also exposed the region’s vulnerability — weak PMIs, slowing manufacturing, and fragile demand.

EURUSD Weekly Projection on the Hourly Chart

The euro initially benefited from tighter trade rhetoric, but the soft growth backdrop kept EURUSD capped, especially as U.S. data held steady enough to prevent a sharp dollar unwind.

🎙️This week:

Markets will watch whether Europe’s geopolitical stance translates into economic confidence — or if it reinforces recession fears. With few major eurozone data releases, EURUSD will take its cues from U.S. yields and the broader risk mood.

A Europe pushing back against China may strengthen the euro politically, but without growth, the currency struggles to follow through.

🇯🇵USDJPY — Policy Divergence Meets Geopolitical Stress

Last week:

U.S. yields remained supported by stable labour-market signals and steady services activity. Meanwhile, Japan stayed committed to ultra-easy policy as domestic inflation softened again. Add in defence-related tension in Asia — from China-EU trade friction to uncertainty around U.S. policy direction — and investors simply kept returning to the dollar.

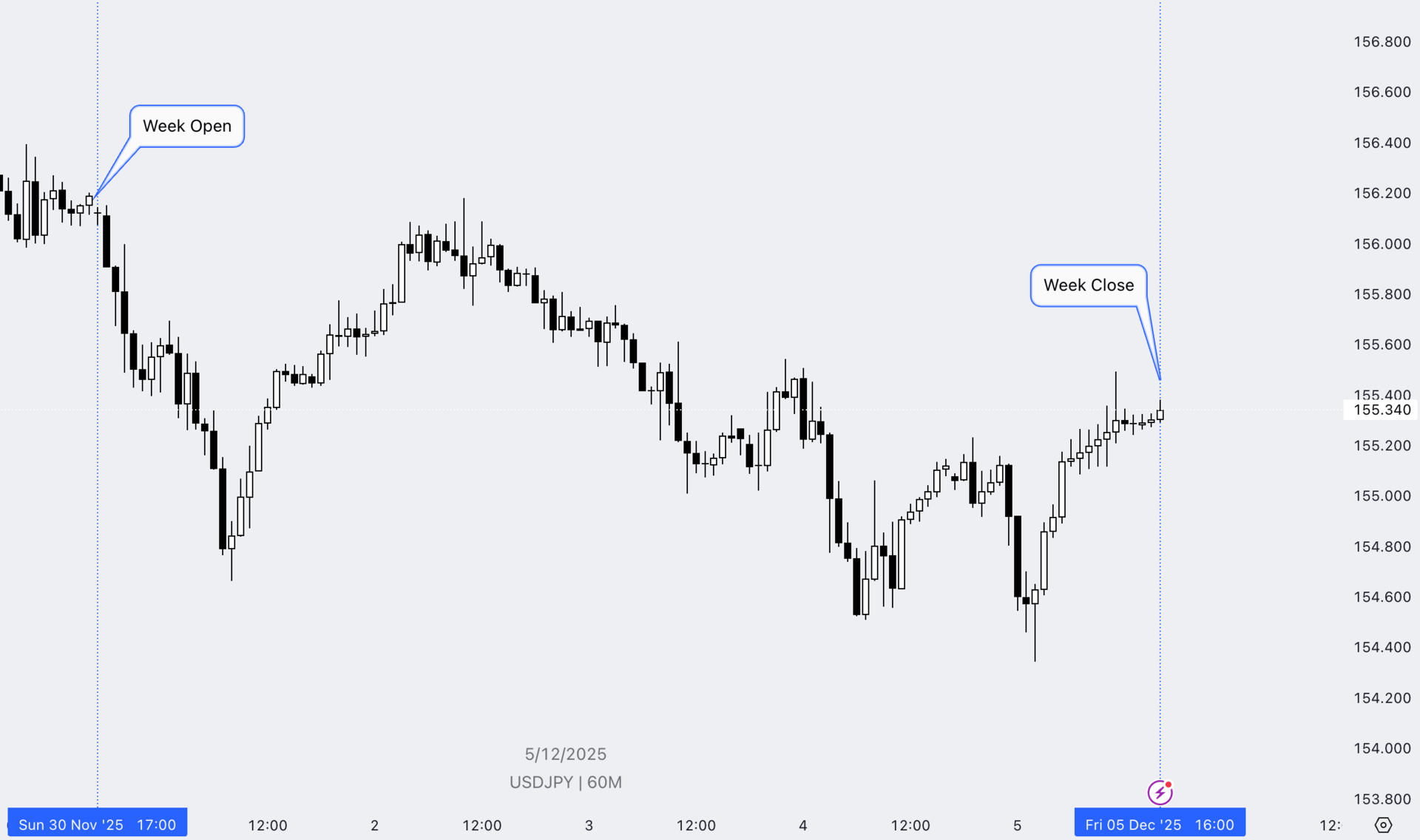

USDJPY Weekly Projection on the Hourly Chart

The result: USDJPY stayed elevated, reflecting both monetary divergence and geopolitical caution.

🎙️This week:

The pair hinges on U.S. inflation expectations and risk sentiment. BOJ remains sidelined, so any pickup in U.S. data resilience or geopolitical uncertainty keeps USDJPY well-bid.

As Europe struggles and China faces pushback, capital flows gravitate toward the dollar — and USDJPY becomes the cleanest expression of that preference.

🟨XAUUSD — Gold Reacts to the Macro “Disconnect”

Last week:

The OECD warned of slowing global growth into 2026 — a “doom-loop” scenario where yields soften and gold demand rises. But risk markets didn’t fully price that yet. Equities held firm, yields stayed elevated, and geopolitical risk was more strategic than immediate.

Gold Weekly Projection on the Hourly Chart

Gold therefore traded sideways to slightly weaker, caught between long-term macro hedging demand and short-term resilience in the dollar.

🎙️This week:

If U.S. data hints at softer inflation or slowing demand, yields could compress, giving gold a clearer path higher. Conversely, if risk sentiment stays firm and USD remains strong on geopolitics, gold’s upside remains constrained.

Gold is the emotional barometer of global uncertainty — but last week’s tensions were structural, not explosive, keeping XAUUSD in wait-and-see mode.

📉NQ Futures — Caught Between AI Optimism and a Slowing World

Last week:

Despite Europe’s slowdown and global manufacturing weakness, tech continued to outperform — supported by strong AI investment and stable U.S. demand. However, geopolitical headlines added a layer of caution: tariffs, supply-chain restructuring, and Europe’s shift toward economic security signal a world becoming more fragmented.

Nasdaq Futures Weekly Projection on the Hourly Chart

That fragmentation is good for U.S. tech dominance long term — but bad for global growth. Thus, NQ drifted, not rallied, reflecting this tug-of-war.

🎙️This week:

Markets will weigh whether corporate optimism can survive a weakening macro narrative. If yields fall, NQ gets a boost. If geopolitical frictions intensify or growth outlooks soften further, NQ may stay choppy.

NQ sits at the intersection of innovation and uncertainty — benefiting from structural tailwinds but held back by the world around it.

🗝️Key Takeaways:

Europe’s new geopolitical assertiveness pressures EURUSD but strengthens the dollar narrative.

U.S.–Japan policy divergence, in a world turning more fragmented, keeps USDJPY supported.

Slowing global growth forecasts build the long-term case for gold — but yields and sentiment still dictate the short-term.

NQ feels the push-pull of a world where innovation remains strong, but the macro backdrop is weakening.

Geopolitics is reshuffling the macro map — and each asset is responding in its own way, but along the same global storyline.

🧪The Technical Corner

With that backdrop set, we now turn to what truly anchors our weekly approach: price action. Fundamentals provide the narrative, but The Technical Corner reveals how the market is actually digesting it. Let’s break down how EURUSD, USDJPY, XAUUSD and NQ are behaving around their key levels — and what the charts are signalling for the week ahead as we head into a slow, holiday-tilted December.

🇪🇺EURUSD: Bullish Structure Holds Above the Daily FVG

EURUSD Daily Chart

EURUSD continues to respect its bullish structure, holding firmly inside the Daily FVG.

Key Points:

Price remains supported inside the Daily FVG, keeping the bullish narrative intact.

No bearish break in structure — pullbacks are still being absorbed.

Our liquidity draw remains unchanged: 1.17280 → 1.19200.

Bias: Bullish

Targets: 1.17280 → 1.19200

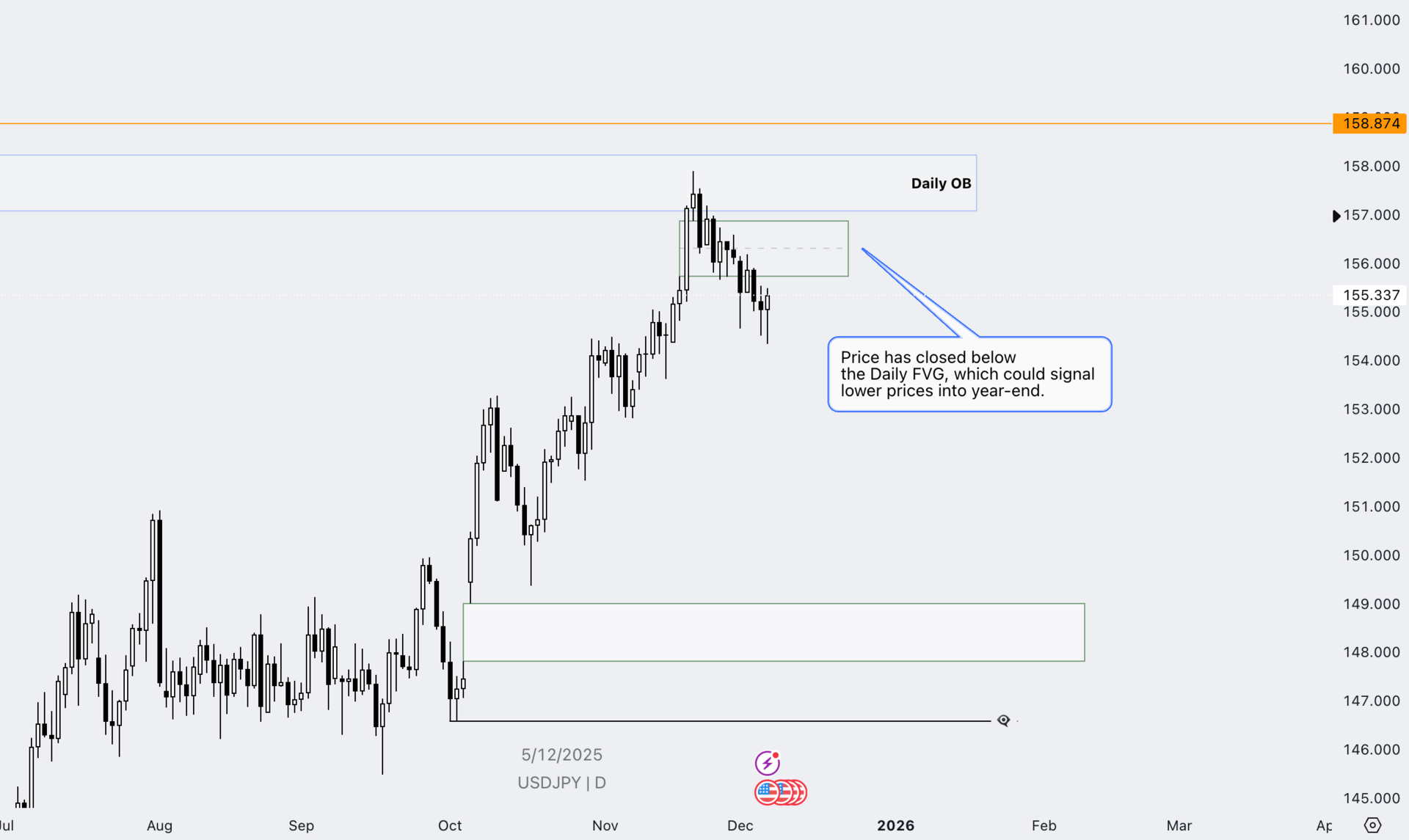

🇯🇵 USDJPY: Closing Below the Daily FVG Signals Potential Weakness

USDJPY Daily Chart

USDJPY has finally closed below the Daily FVG, shifting momentum and hinting at potential downside into year-end.

Key Points:

A clean close below the Daily FVG marks a loss of bullish momentum.

Structure is beginning to tilt lower, with sellers taking control for the first time in weeks.

Unless price reclaims the FVG, we can expect a deeper move toward lower liquidity levels.

Bias: Bearish

Targets: Lower prices toward the next major support zone

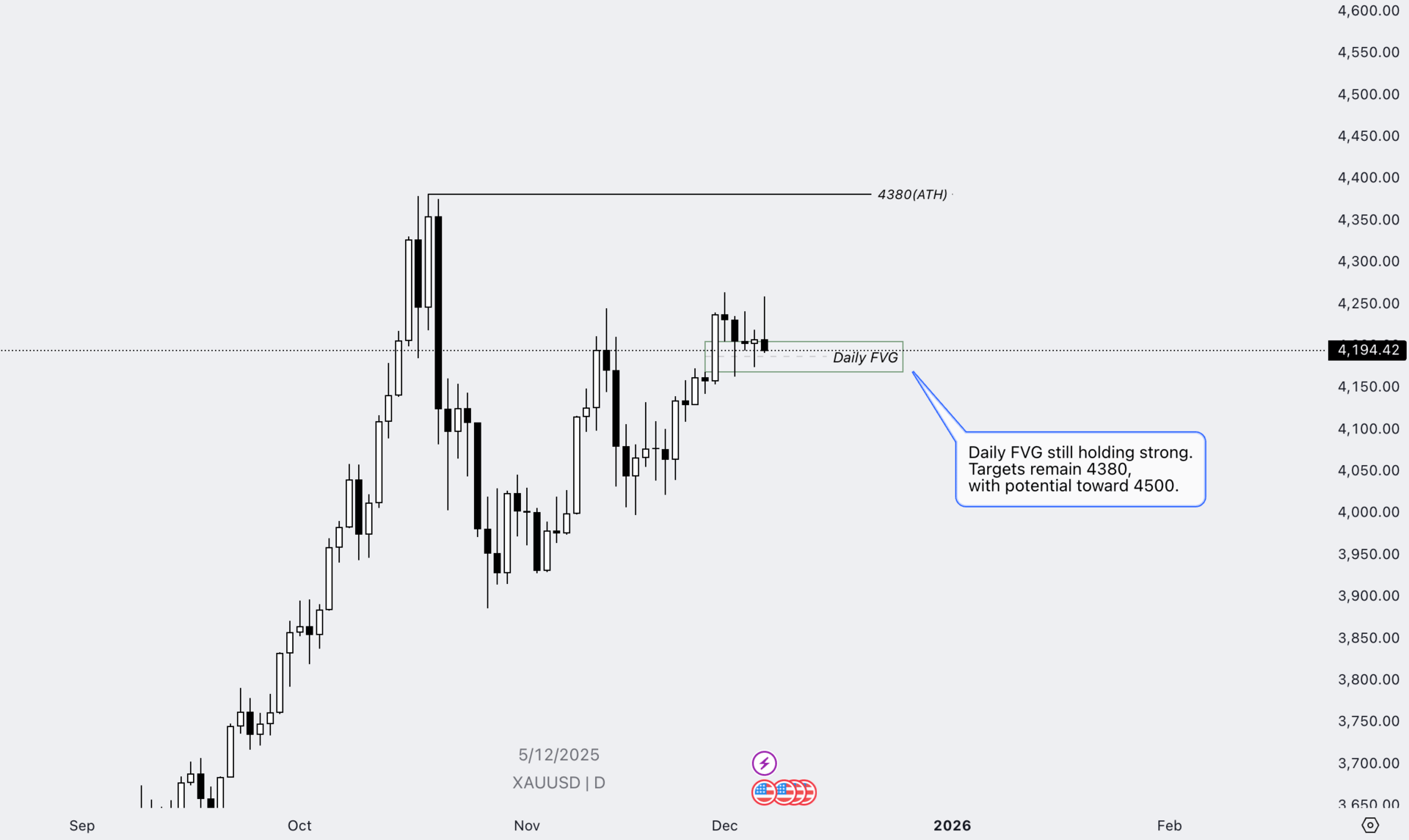

🟨XAUUSD: Daily FVG Holding Firm, Targets Unchanged

XAUUSD Daily Chart

Gold continues to respect the Daily FVG, maintaining its bullish structure despite recent consolidation.

Key Points:

Price is holding strongly above the Daily FVG, showing clear support.

No bearish displacement — structure remains constructive.

Our upside draws stay the same: a move toward 4380 (ATH) with potential extension toward 4500.

Bias: Bullish

Targets: 4380 → 4500

📉NASDAQ Futures (NQ): First Target Swept, Eyes on a Breakout

NQ Futures H4 chart

NQ has cleared our first target, and price is now pressing against a key range high.

Key Points:

The initial buyside target has been swept, confirming bullish follow-through.

A clean close above 25,830 opens the door for a continuation squeeze.

If that breakout confirms, the next draw sits at 26,266.00.

Bias: Bullish (conditional on a breakout)

Targets: 25,830 reclaim → 26,266

🧩Final Word

This week proved how closely fundamentals and technicals are aligned. Geopolitics shaped the macro tone — from Europe’s tightening stance on China to slowing global data — while price action responded with precision: EURUSD held its Daily FVG, USDJPY slipped below structure, XAUUSD stayed supported, and NQ pushed toward breakout levels.

As we move further into December — a historically slow, low-liquidity month — the priority shifts from chasing moves to letting price action speak. Stay patient, stay selective, and let structure lead the way into year-end.

And Remember….

December reminds us: doing nothing is also a position.

Stay safe and happy trading!

— The UE Market Letter Team 👁️🗨️

© 2025 UE Market Letter. All rights reserved.

The information shared in the UE Market Letter is intended solely for educational and informational purposes. It should not be interpreted as financial, investment, or trading advice. All views expressed reflect the author’s personal analysis and opinions and are not recommendations to buy, sell, or hold any financial instrument. Trading and investing carry inherent risks and may not be suitable for every investor. Market performance is uncertain — past results do not guarantee future outcomes. Readers are encouraged to conduct their own research and seek guidance from a licensed financial advisor before making any investment decisions. UE Market Letter and its authors accept no liability for any loss or damage arising from reliance on the content provided.