📰Last week (9th – 14th November) markets were driven almost entirely by the U.S. dollar, as political uncertainty from the ongoing government shutdown, shifting Fed expectations, and uneven global data created a fragile macro backdrop. With official U.S. releases still frozen and traders relying on policy tone and yields for direction, the dollar lost some momentum — a shift that echoed across EUR/USD, USD/JPY, Gold, and NQ futures. As we head into the week of the 16th – 21st of November, the same theme persists: the dollar remains the fulcrum, and every major asset we track is now moving in response to how the market prices U.S. risk, policy, and the timeline for reopening the data calendar.

DXY (Dollar Index) Weekly Projection on the Hourly Chart

🗞️What Happened Last Week

The U.S. shutdown dragged on, but whispers of a deal boosted risk-taking and softened demand for the dollar.

With U.S. data frozen and recent releases turning weaker, markets leaned back toward rate-cut expectations, putting further pressure on the dollar.

Meanwhile, Japan and others kept policy loose, sharpening divergence and adding volatility to FX flows.

As the dollar wavered, markets recalibrated: equities steadied, gold surged, and risk assets regained momentum.

📝Why It Matters

When the dollar slips, EUR/USD rises, USD/JPY cools, gold catches a bid, and tech futures like NQ rally — and last week was a clear example of that dynamic.

But if the dollar snaps back on hawkish Fed tone or renewed safe-haven demand, the entire cross-asset picture flips instantly.

Everything now hinges on one thing: the dollar’s next move in a tug-of-war between policy expectations and political uncertainty.

With that backdrop in place, we can now look at how each asset reacted — and where it may head next. EUR/USD, USD/JPY, Gold, and NQ all moved differently last week, but every move came back to one thing: the dollar losing momentum 💵📉.

Let’s break them down.

🇪🇺 EUR/USD - Dollar Softness Gives the Euro Space to Recover

Last Week (9th -14th)

As the shutdown dragged on and the dollar lost its safe-haven shine, EUR/USD finally found room to breathe.

With U.S. data frozen and markets leaning back toward rate-cut expectations, the euro benefitted from traders stepping away from the USD.

Risk sentiment improved just enough to keep pressure on the dollar, allowing EUR/USD to grind higher through the week.

EURUSD Weekly Projection on the Hourly Chart

This Week (16th – 21st Nov)

If the dollar stays on the back foot — helped by shutdown progress or continued dovish expectations — EUR/USD is likely to extend its recovery.

But the story can flip quickly: a hawkish Fed remark or sudden risk-off turn could revive dollar demand and cap the euro’s momentum.

This week’s narrative remains simple: EUR/USD rises only as long as the dollar stays weak.

🗝️Key takeaway: The softening dollar is giving EUR/USD room to rise, but it remains vulnerable to a renewed dollar bid.

🇯🇵 USD/JPY - Policy Divergence Keeps the Pair Supported

Last week (9th – 15th Nov):

USD/JPY pushed higher as the yen stayed on the back foot, weighed down by Japan’s still-loose policy stance.

Even with the dollar softening elsewhere, the yield gap between the U.S. and Japan kept favouring USD strength in this pair.

Risk sentiment improved as shutdown negotiations progressed, reducing demand for the yen’s safe-haven qualities and allowing USD/JPY to hold elevated levels.

USDJPY Weekly Projection on the Hourly Chart

This Week (16th – 21st Nov)

If the dollar remains weak overall, USD/JPY could finally lose momentum — especially if markets shift further toward Fed rate-cut expectations.

But Japan’s policy divergence leaves the yen vulnerable: any rebound in the dollar, even a mild one, can quickly drive USD/JPY higher again.

The story this week is a tug-of-war: a soft dollar pulls USD/JPY down, but Japan’s ultra-loose policy keeps the upside alive.

🗝️Key takeaway: USD/JPY is a clear play on dollar dominance vs yen; the dollar’s direction will almost entirely determine the yen‐cross outcome.

🟨 Gold (XAU/USD)- A Hesitant Dollar Boosts Demand

Last week (9th – 15th Nov):

Gold surged as the dollar lost momentum and markets leaned harder into the idea of future Fed rate cuts.

Shutdown uncertainty and frozen U.S. data pushed investors toward assets less tied to the U.S. political mess — giving gold a clean boost.

With risk sentiment improving but the dollar still soft, gold enjoyed the rare mix of lower yields, weaker USD, and growing demand for alternative havens.

Gold (XAUUSD) Weekly Projection on the Hourly Chart

This Week (16th – 21st Nov)

If the dollar continues to soften and rate-cut expectations remain in play, gold has room to stay elevated or extend higher.

But gold’s rally is fragile: any hawkish shift from the Fed or sudden dollar rebound could trigger a quick pullback.

This week’s narrative remains straightforward: gold thrives as long as the dollar struggles — and stalls the moment the dollar finds its footing.

🗝️Key takeaway: Gold is riding the softer‐dollar, rate‐cut narrative—but the dollar remains the fulcrum.

📊Nasdaq-100 Futures (NQ)- Risk Appetite Improves as the Dollar Cools

Last week (9th – 15th Nov):

Tech found support as the dollar softened and shutdown negotiations hinted at progress, easing some of the macro tension weighing on risk assets.

With U.S. data frozen and markets drifting back toward rate-cut expectations, yields stayed contained — giving growth sectors like tech room to stabilise.

As the dollar wavered, investors rotated back into risk, allowing NQ to recover after weeks of uncertainty.

NQ Weekly Projection on the Hourly Chart

This Week (16th – 21st Nov)

If the dollar remains weak and yields stay suppressed, NQ could continue building on last week’s momentum.

But the rally is vulnerable: a hawkish Fed tone, renewed shutdown tension, or a sudden dollar rebound could quickly pressure tech again.

The narrative is simple: NQ rises when the dollar eases and financial conditions loosen — and stalls the moment the dollar strengthens.

🗝️Key takeaway: NQ’s direction is indirectly tied to the dollar: a weaker dollar supports risk assets; a firmer dollar may dampen them.

🔭 What we can expect

🔍 Primary scenario: The U.S. dollar remains under pressure. Expect:

EUR/USD to rise toward ~1.17-1.18,

USD/JPY to consolidate or even pull back from highs unless dollar strength re-emerges,

Gold to test extension toward US$4,300 if dollar stays weak,

NQ futures to benefit from the risk-on/backdrop of a softer dollar.

🔎 Risk scenario (dollar re-asserts):

EUR/USD is expected to turn lower if the dollar regains strength.

USD/JPY would likely push higher, supported by the U.S.–Japan yield gap.

Gold could pull back, giving up recent gains if the dollar firms.

NQ may come under pressure, as stronger USD conditions usually weigh on tech and risk assets.

🎙️ For this week, monitor key U.S. data/fiscal updates (government shutdown endgame, inflation/PMI prints), Fed commentary, and global risk-sentiment shifts — these will determine whether the dollar remains the anchor or the catalyst for a broader reversal.

🧪The Technical Corner

With the fundamentals set and the dollar shaping the broader landscape, it’s time to shift into the part of the newsletter that matters most for execution — The Technical Corner. This is where we leave the macro narrative behind and let structure, liquidity, and price action tell the real story.

📈📉 Let’s dive into the charts .

🇪🇺 EURUSD

EURUSD Daily Chart

On the Daily Chart, we can see that:

Strong bounce from the Daily FVG has shifted the draw toward the 50% equilibrium of the range.

Price is now heading into the premium zone / Daily OB, the key decision point for this move.

A rejection there would likely reconfirm the broader bearish structure.

Buyside at 1.19200 is the extreme target only if price can break through the OB cleanly.

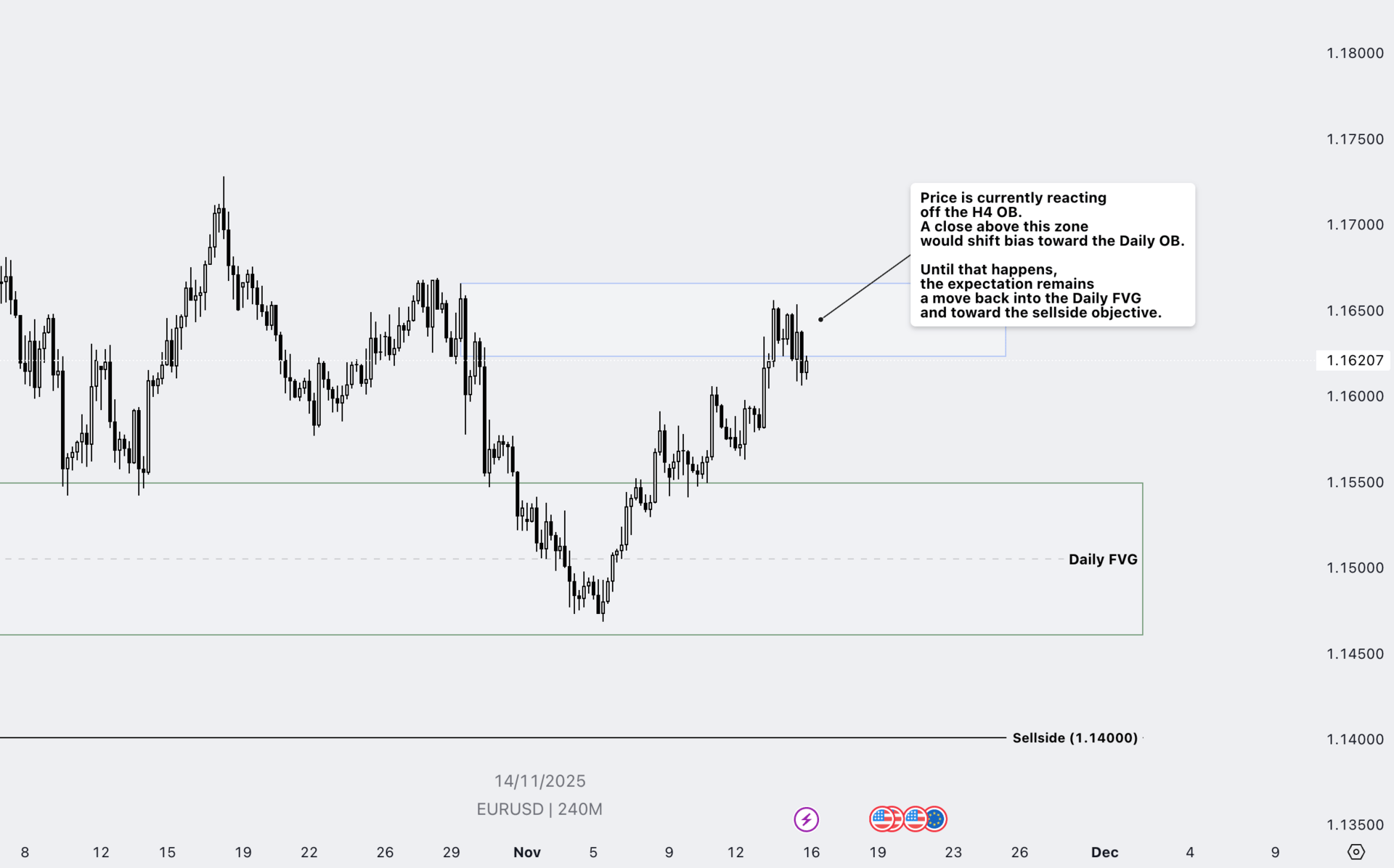

Lets zoom into the 4 Hour Chart:

EURUSD H4 Chart

Price is reacting from the H4 OB, showing hesitation as it approaches short-term resistance.

A clean close above this zone would shift the draw higher toward the Daily OB and the premium range.

Until that break happens, the expectation remains a pullback into the Daily FVG below.

Failure to hold intraday structure could reopen the path toward the 1.14000 sellside objective.

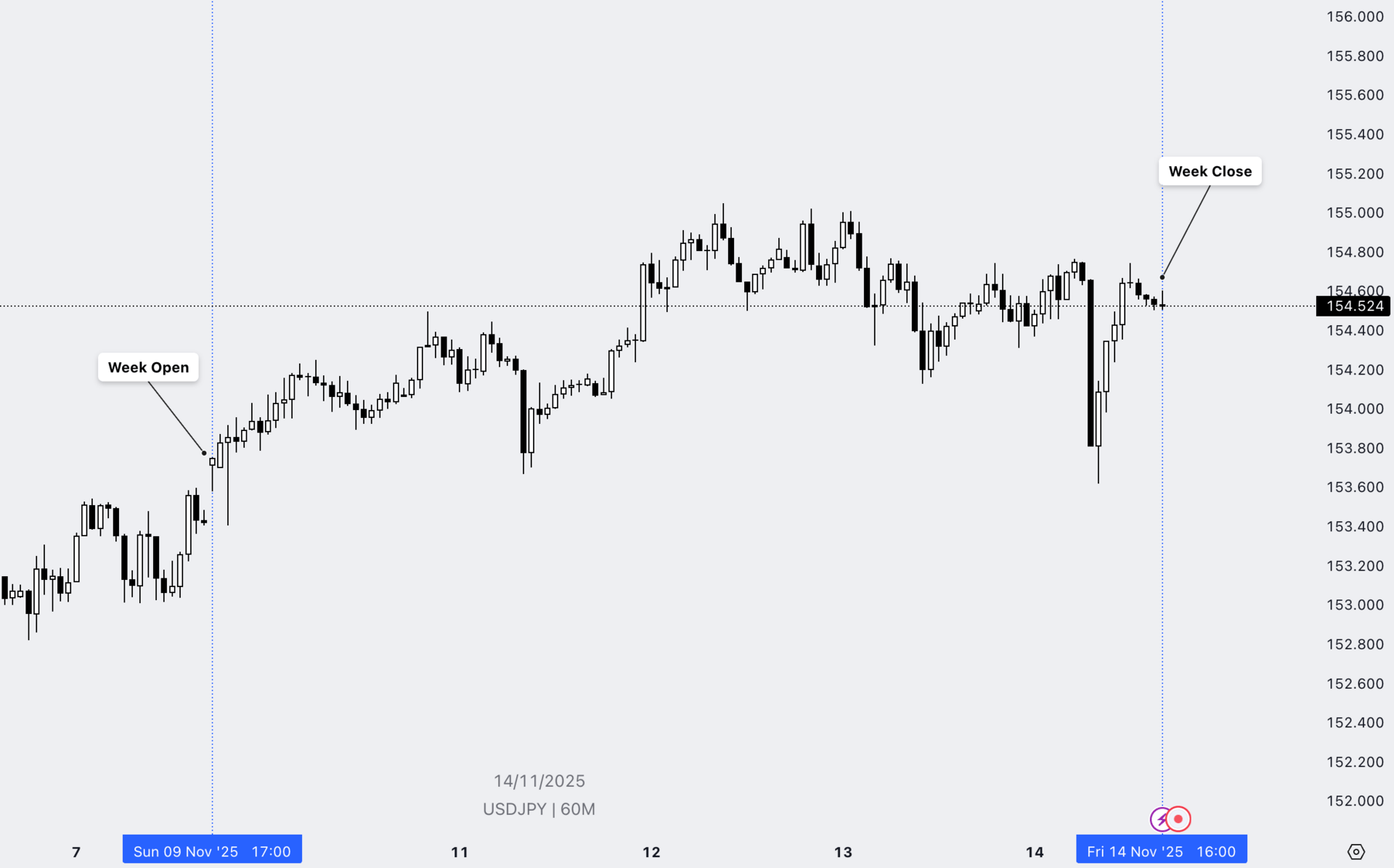

🇯🇵 USDJPY

Our USDJPY roadmap has been spot on for five weeks straight, and price continues to respect every level we’ve outlined.

USDJPY Daily Chart

Price reacted cleanly from the Daily FVG, validating our bullish continuation bias.

Buyside liquidity at 154.800 has been swept, matching our projected path.

The next draw on liquidity remains unchanged at 157.000, where the higher-timeframe objective sits.

As long as price holds above the reclaimed OB zone, the structure continues to favour a push into the Daily OB above.

Lets zoom into the 4 hour Chart:

USDJPY H4 Chart

H4 shows a clean reaction from the FVG/OB zone, perfectly aligning with the higher-timeframe bullish structure.

The rejection confirms ongoing bullish order flow, supporting our continuation bias.

As long as this zone holds, the draw remains firmly toward 157.000.

Intraday structure suggests price is preparing to push higher into the Daily OB.

Our Bias remains Bullish

🟨XAUUSD

XAUUSD Daily Chart

On the Daily:

Price is currently trading around the 50% equilibrium of the bearish leg, showing hesitation at a key decision point.

We are seeing reactions from both a bullish FVG below and a bearish FVG above, creating a temporary tug-of-war in structure.

Until one side breaks cleanly, the bias remains neutral short-term — we’re waiting to see which imbalance price decides to draw toward first.

On the H4:

XAUUSD H4 Chart

Price has rejected sharply from our marked zone, confirming the bearish reaction we anticipated.

Short-term bias leans bearish, but we’re watching how price interacts with the H4 FVG below, as this will dictate the next leg.

A clean reaction from the FVG could provide a temporary bounce, while a break through it opens the path for deeper downside.

Until structure shifts, the focus remains on how price behaves around this imbalance in the coming sessions.

📊NASDAQ Futures (NQ)

NQ H4 Chart

Price has tapped into a key support zone and reacted with a clear bullish response, holding structure for now.

This reaction opens the door for a short-term move toward the 25,800 region, our initial upside objective.

A deeper pullback into the support zone remains possible, so we’ll watch which direction price commits to first.

As long as the support holds, the bias leans bullish — but confirmation depends on the next H4 impulse.

🧩Final Word

This week’s charts give us a mixed landscape. USDJPY remains the only pair with a clear, confident trajectory, continuing to respect every level we’ve mapped out for five straight weeks. Our draw on liquidity at 157.000 remains firmly intact.

Across the other assets — EURUSD, Gold, and NQ — price is sitting at important decision points. Each of them is reacting from key imbalances or support zones, but none have yet shown a decisive commitment in either direction. Because of that, forecasting the next leg with certainty isn’t yet possible, and we’ll be patient until price reveals where it wants to go first.

As always, we’ll reassess structure, liquidity, and momentum in a few days.

Expect a full update in our Mid-Week Technical Corner (every Wednesday 18:30 EST) , where we’ll refine the outlook once price makes its intentions clear.🧪

That brings this week’s UE Market Letter to a close. As the week unfolds, stay patient, stay adaptable, and let price reveal the truth before you commit — especially in a dollar-driven environment where certainty is rare and clarity appears only to the disciplined.

Remember…

“The market doesn’t reward prediction — it rewards preparation.”

Stay Safe and Happy Trading!👁️🗨️

— The UE Market Letter Team.

© 2025 UE Market Letter. All rights reserved.

The information shared in the UE Market Letter is intended solely for educational and informational purposes. It should not be interpreted as financial, investment, or trading advice. All views expressed reflect the author’s personal analysis and opinions and are not recommendations to buy, sell, or hold any financial instrument. Trading and investing carry inherent risks and may not be suitable for every investor. Market performance is uncertain — past results do not guarantee future outcomes. Readers are encouraged to conduct their own research and seek guidance from a licensed financial advisor before making any investment decisions. UE Market Letter and its authors accept no liability for any loss or damage arising from reliance on the content provided.