📰Last week (17–21 Nov) delivered a messy but defining mix for global markets. The dollar held firm as EURUSD stayed pressured and USDJPY pushed toward cycle highs, supported by wide rate differentials and renewed carry demand. U.S. jobs data surprised on the headline but showed rising unemployment and softer wage growth, keeping the December Fed cut in question. Tech and AI names swung sharply — Nvidia’s earnings euphoria flipped into a broader selloff before stabilising on late-week dovish Fed signals. Meanwhile, Europe’s PMIs painted a steady but uneven picture, and Japan’s new ¥21.3tn stimulus package fuelled fresh yen weakness amid concerns over long-term fiscal strain.

📝This sets the tone for the holiday-shortened week ahead (24–28 Nov), where direction will come from delayed U.S. data — retail sales, PPI, consumer confidence, jobless claims, and the Fed’s Beige Book — alongside crucial Black Friday spending signals. Global sentiment surveys in the Eurozone, Germany, and Japan will reveal whether growth outside the U.S. can keep pace.

With this backdrop of firm dollar momentum, fragile risk appetite, and shifting policy expectations, we now turn to how these forces shape EURUSD, USDJPY, Gold, and the Nasdaq.

🇪🇺EURUSD – Between a Firm Dollar and a Stabilising Eurozone

Last week (17–21 Nov)

The dollar stayed in control, keeping EURUSD heavy even as the euro tried to stabilise above short-term moving averages.

Eurozone data wasn’t disastrous: business activity grew modestly, with services expanding at the fastest pace in ~18 months, while manufacturing slipped back into contraction. That’s resilience, but not enough to decisively outshine the U.S. story.

In the U.S., stronger-than-forecast jobs data but higher unemployment and delayed inflation releases left traders unsure whether the Fed will cut in December — supporting the dollar via uncertainty rather than clear conviction.

EURUSD Weekly Projection on the Hourly Chart

This week (24–28 Nov)

EURUSD will trade around a data catch-up versus confidence theme:

The U.S. releases backlogged retail sales and PPI, plus consumer confidence and jobless claims — all key for rate expectations and the dollar.

The Euro area sees confidence indicators and business surveys, and Germany publishes more detailed growth data.

If U.S. data come in soft while Eurozone surveys hold up, EURUSD gets room for a corrective bounce. Strong U.S. prints or weak Euro sentiment keep the dollar-uptrend narrative alive.

Structurally, EURUSD remains our “global growth vs USD strength” barometer — the pair that reflects whether markets still believe in a soft landing outside the U.S., or retreat back into dollar safety.

🗝️Key takeaway: Mixed Euro data and uncertain Fed path keep EURUSD tilted toward dollar strength.

🇯🇵 USDJPY – Stimulus, Carry and a Soft Yen

Last week (17–21 Nov)

USDJPY pushed to its highest level since January, powered by wide rate differentials and ongoing demand for carry trades while the Fed remains only cautiously dovish.

Politically, Japan’s new Prime Minister Sanae Takaichi unveiled a huge ¥21.3tn stimulus package — subsidies, cash handouts and support for strategic sectors — aimed at reviving growth and cushioning households from rising costs.

Markets welcomed growth support but worried about the fiscal cost, helping push the yen to a 10-month low before a modest rebound.

On the data side, Japan’s manufacturing PMIs still show contraction in factories, even as broader business confidence has begun to improve — a mixed signal that leaves the BoJ in no rush to tighten policy.

USDJPY Weekly Projection on the Hourly Chart

This week (24–28 Nov)

The Japan calendar is lighter, but markets will track local releases and any BoJ commentary against the new fiscal package.

For USDJPY, the real driver stays external:

If U.S. data and Fed rhetoric rekindle hopes of a December cut, yields could slip and cool the move higher.

If data reaffirm U.S. resilience and keep the Fed cautious, the carry trade remains attractive, and dips in USDJPY are likely to find buyers.

Big picture: Japan’s loose monetary stance plus fresh fiscal easing mean the “weak yen / strong USD” regime is still the default, unless we see a clear shift from the Fed or BoJ.

🗝️Key takeaway: Japan’s stimulus + wide rate differentials continue to favour a stronger USDJPY.

🟨XAUUSD – Safe Haven vs Strong Dollar

Last week (17–21 Nov)

Gold traded as a tug-of-war between safe-haven demand and a firm dollar:

Geopolitical jitters and anxiety around delayed U.S. data kept a floor under gold, with analysts expecting a moderate rise into late November on inflation worries and broader turbulence.

At the same time, a still-strong USD and relatively elevated real yields limited upside, especially as carry trades (e.g., USDJPY) remained attractive and risk assets sold off more violently than gold.

XAUUSD Weekly Projection on the Hourly Chart

This week (24–28 Nov)

For XAUUSD, the focus is on how the incoming data reshape the Fed path:

Softer-than-expected U.S. retail sales, PPI and confidence numbers would pull yields lower and weaken the dollar at the margin, giving gold room to extend higher.

Strong data that revives fears of “higher for longer” on real rates would cap rallies and keep gold in range-trade / mean-reversion mode rather than a clean trend.

With tech and AI names showing cracks and consumer sentiment hovering near historical lows, gold remains the insurance trade in this environment — but its ability to trend depends on whether the Fed story breaks decisively dovish.

🗝️Key takeaway: A firm dollar and weak risk sentiment are limiting gold’s ability to move higher, even with some safe-haven demand in the background.

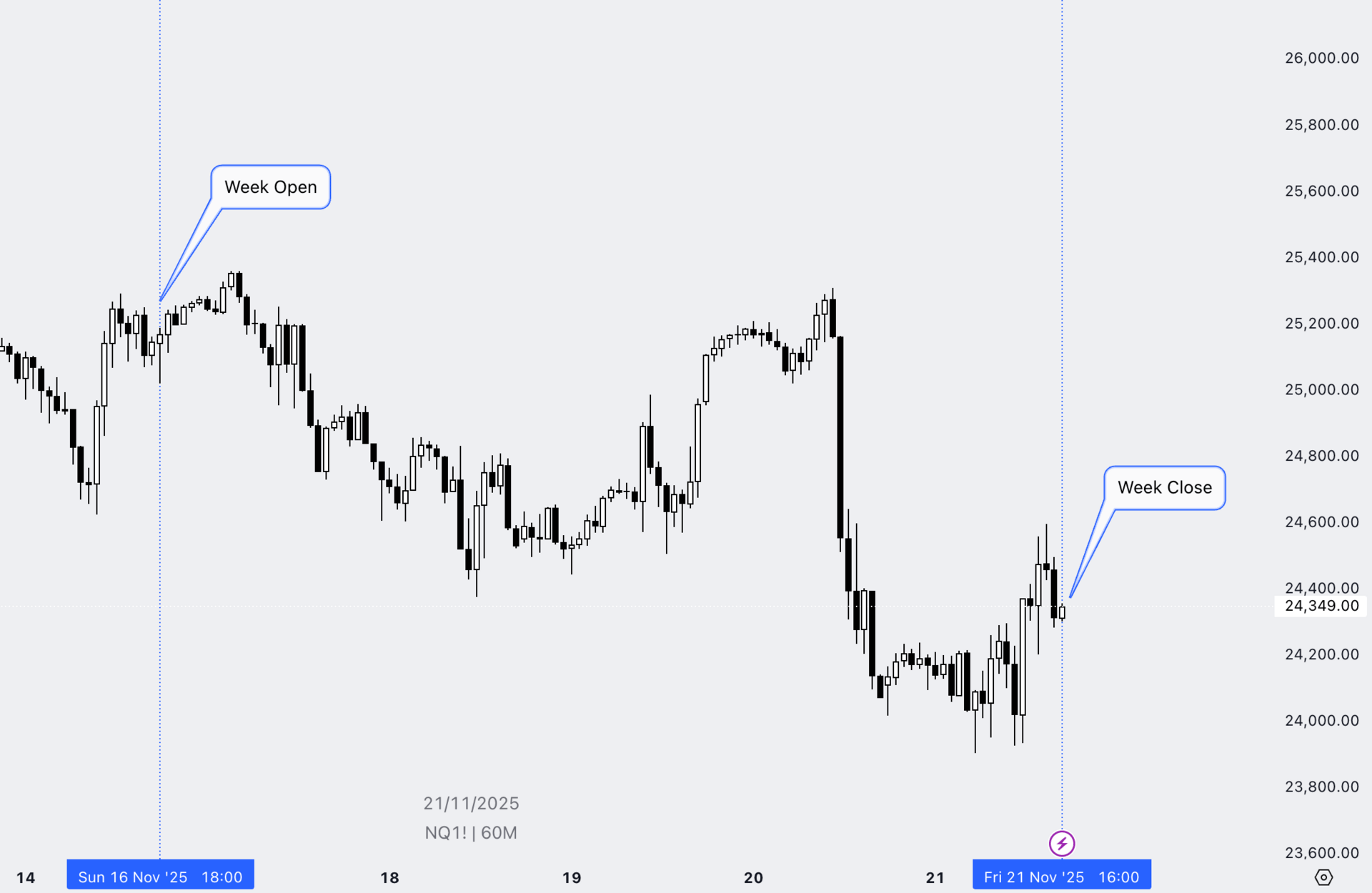

📉NQ Futures – AI Euphoria Meets Rate-Cut Doubts

Last week (17–21 Nov)

The Nasdaq 100 had a volatile week:

Nvidia’s blockbuster earnings initially fuelled another AI-driven surge, but that quickly reversed into a broader tech and speculative asset selloff, dragging NQ below its 50-day moving average.

Later in the week, comments from Fed officials — especially John Williams signalling openness to a near-term rate cut — pushed rate-cut odds for December above 70%, helping NQ futures rebound.

The result: NQ is now caught between fading AI euphoria and hopes that the Fed will cushion the slowdown.

Nasdaq Futures Weekly Projection on the Hourly Chart

This week (24–28 Nov)

NQ trades into a holiday-shortened, consumer-focused week:

U.S. markets will watch Black Friday / Cyber Monday spending and related data to gauge how much fuel is left in the consumer, after sentiment dropped to multi-year lows earlier in November.

Backlogged U.S. releases — especially retail sales and PPI — will shape how aggressively markets can price cuts beyond December.

If consumer data hold up and Fed commentary leans dovish, NQ has scope to stabilise or grind higher from support. If we see weak spending plus hawkish pushback from Fed speakers, the index remains vulnerable to another leg of de-risking, especially in crowded AI/tech names.

🗝️Key takeaway: Choppy tech markets and uncertainty around Fed rate cuts leave NQ exposed to more risk-off pressure.

🔗How It All Connects

Taken together, these markets capture the broader macro narrative: EURUSD reflects Europe’s modest resilience against a data-dependent Fed; USDJPY showcases widening policy divergence as Japan doubles down on stimulus while U.S. rates remain sticky; Gold acts as the safety valve, responding to shifts in real yields and fragile risk sentiment; and NQ sits at the intersection of Fed expectations and tech-driven volatility. Together, they paint a market still searching for clarity as fundamentals remain mixed and momentum uneven.

🧪The Technical Corner

With the macro backdrop still defined by a firm dollar, uneven global momentum, and a critical week of U.S. data ahead, price now becomes our clearest guide. Fundamentals set the tone, but the next move in EURUSD, USDJPY, Gold, and the Nasdaq will come down to how price reacts around key imbalances, FVGs, and liquidity zones. In this week’s Technical Corner, we break down structure, momentum, and the levels that matter most as the market prepares for late-November volatility.

📈📉 Let’s dive into the charts !

🇪🇺 EURUSD

EURUSD Daily Chart

EURUSD followed our roadmap perfectly last week, rejecting the Daily OB and sliding back into the Daily FVG. With price now sitting inside this imbalance, structure remains bearish and the next move hinges on how price responds around this FVG boundary.

Key Points:

Strong rejection from the Daily OB sent price back into the FVG as projected.

Price is now trading inside the Daily FVG, signalling slower momentum and possible consolidation.

As long as the FVG holds, the 1.14000 sell-side target remains the primary draw.

Any rallies into minor imbalances are likely to be reactive, not trend-changing.

A clean break and close below the FVG would confirm continuation lower into deeper liquidity.

Zooming into the H4:

EURUSD H4 Chart

Price continues to respect the bearish structure, reacting cleanly to imbalances and drawing toward deeper liquidity.

Price respected the H4 FVG and continued lower.

We’re inside the Daily FVG, so momentum may slow or shift.

As long as we stay below the H4 FVG, 1.14000 remains the draw.

Any bounces into H4 imbalances are likely reactive, not reversals.

Bias stays bearish unless structure breaks above the imbalance.

🇯🇵 USDJPY

USDJPY Daily Chart

USDJPY continues to respect our higher-timeframe roadmap, delivering a sharp reaction from the Daily OB exactly as anticipated. Price is now testing the Daily FVG, where the next move will determine whether we hold for higher targets or secure remaining profits.

Key Points

Price rejected the Daily OB cleanly, confirming our expected reaction.

We are now testing the Daily FVG, a key decision point for short-term direction.

A strong close below the Daily FVG = we close the final 20% of our position.

A bullish reaction from this FVG keeps our upside targets intact: 158.900 → 161.900.

Structure remains bullish overall, unless price breaks decisively below the imbalance.

🟨XAUUSD

XAUUSD Daily Chart

Gold spent the week trapped between two key FVGs, consolidating around the 50% level of the recent bearish leg. This range-bound behaviour reflects indecision and aligns with the broader macro uncertainty.

Key Points

Price remained range-bound between the two FVGs throughout the week.

Consolidation is occurring right near the 50% of the bearish leg, a typical zone for temporary equilibrium.

No clear momentum shift yet — price continues to hover inside overlapping imbalances.

A break above the upper FVG signals short-term bullish relief; failure to hold leads back toward the short-term target below.

Until structure breaks, gold remains neutral-to-bearish, reacting to imbalances rather than trending.

On the H4:

XAUUSD H4 Chart

Gold continues to respect bearish structure, holding below the FVG and keeping short-term downside in play.

Key Points

Price is respecting the H4 bearish FVG, confirming the rejection.

As long as we stay below this imbalance, the bearish bias remains intact.

Current consolidation suggests weak momentum, not reversal strength.

Short-term draw remains around ~3885, in line with the broader bearish leg.

A break above the H4 FVG would be the first sign of relief, but not a trend shift on its own.

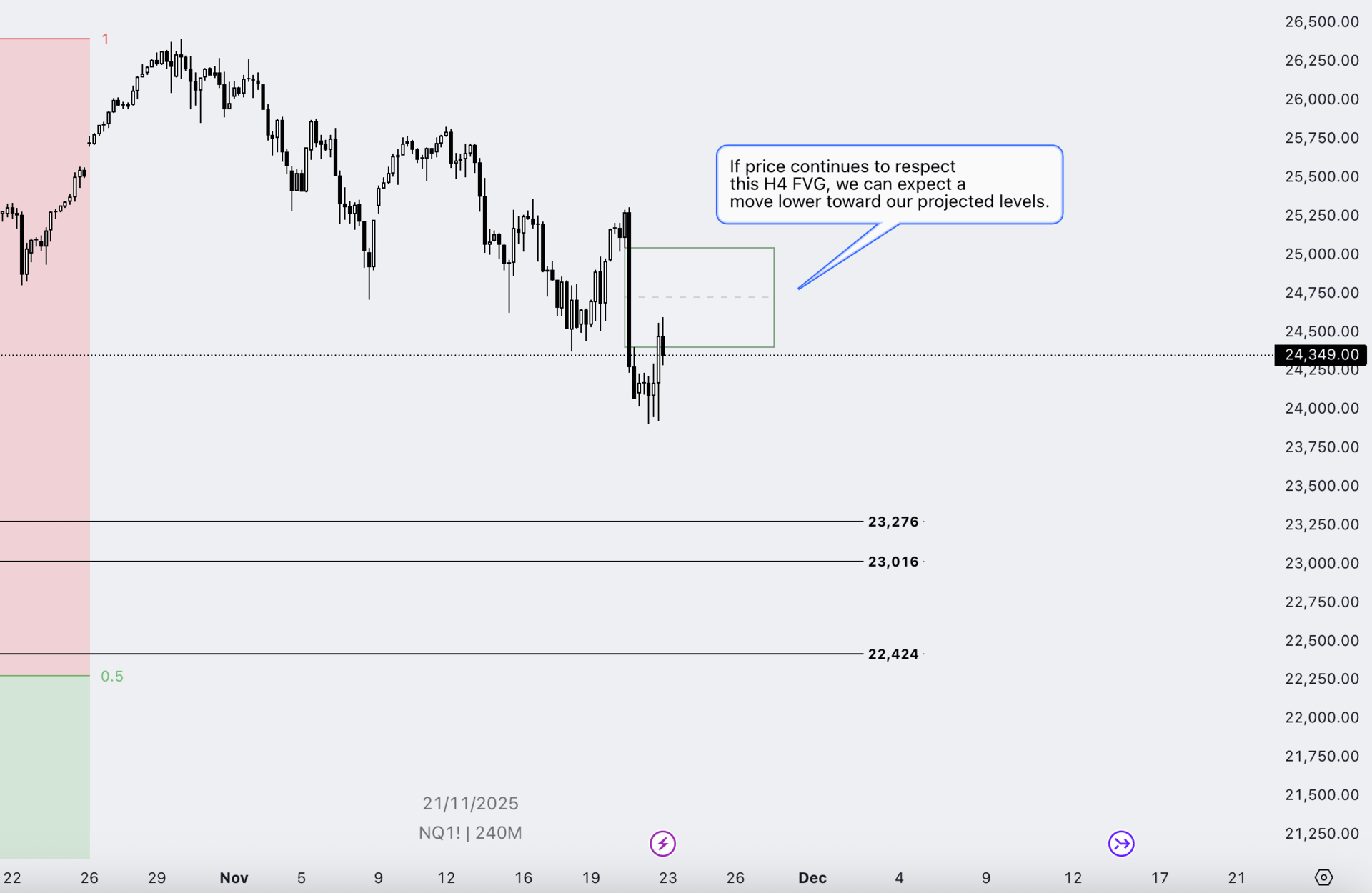

📉NASDAQ Futures (NQ)

NQ Daily Chart

NQ turned sharply lower last week, rejecting the Daily OB with precision and shifting structure firmly bearish. Price is now drawing toward key downside targets as momentum follows through.

Key Points

Strong rejection from the Daily OB confirmed the bearish shift.

Structure is now clearly bearish, with lower highs forming after the OB rejection.

Price is drawing toward Target 1 and Target 2, aligning with the current bearish leg.

The major support / key level sits lower, inside the larger discounted zone.

Until price reclaims the Daily OB, any bounce remains corrective, not a trend reversal.

Zooming into the H4:

NQ H4 chart

NQ continues to respect bearish imbalances, with the recent reaction from the H4 FVG keeping downside momentum firmly intact.

Key Points

Price is respecting the H4 FVG, reinforcing the bearish structure.

As long as we stay below this imbalance, lower prices remain likely.

Short-term momentum favours a draw toward our projected levels: 23,276 → 23,016 → 22,424.

Current bounce looks reactive, not a shift in trend.

A break and close above the H4 FVG would be the first sign of relief, but the bias remains bearish for now.

🧩Final Word

This week’s price action across EURUSD, USDJPY, Gold, and NQ reinforces a simple truth: when fundamentals are mixed and data is fragmented, structure and liquidity become the clearest guides. Each market has responded cleanly to key imbalances — whether rejecting OBs, respecting FVGs, or drawing toward obvious liquidity pools — giving us a reliable framework as we head into a data-heavy, holiday-shortened week.

With delayed U.S. releases, shifting Fed expectations, and uneven global momentum, volatility can pick up without warning. Stay patient, let the market reveal its intention at key levels, and avoid forcing conviction where the chart hasn’t earned it yet. The roadmap is clear — now it’s about execution and discipline.

Remember….

Clarity comes to those who wait — not to those who chase.

Stay safe, stay focused, and happy trading.👁️🗨️

— The UE Market Letter Team

© 2025 UE Market Letter. All rights reserved.

The information shared in the UE Market Letter is intended solely for educational and informational purposes. It should not be interpreted as financial, investment, or trading advice. All views expressed reflect the author’s personal analysis and opinions and are not recommendations to buy, sell, or hold any financial instrument. Trading and investing carry inherent risks and may not be suitable for every investor. Market performance is uncertain — past results do not guarantee future outcomes. Readers are encouraged to conduct their own research and seek guidance from a licensed financial advisor before making any investment decisions. UE Market Letter and its authors accept no liability for any loss or damage arising from reliance on the content provided.