Across 20–24 Oct the market painted a theme of expectations for Fed easing vs. central banks staying put. U.S. data softened late in the week — notably September CPI printed a touch below consensus on 24 Oct — which weakened the dollar into Friday and reinforced market pricing for an imminent Fed cut at the October FOMC. At the same time, ECB messaging stayed broadly ‘on hold’ and Japan’s policy stance left the yen vulnerable, so currency moves were dominated by shifts in U.S. rate expectations and relative yield dynamics.

💲How the Dollar’s Move Tied EURUSD and USDJPY Together

When markets push up the odds of Fed cuts, the dollar tends to ease — which helps EURUSD and undermines USDJPY only to the extent Japan’s yields move or BoJ signals change. Conversely, geopolitical/risk moves or a widening U.S.–Japan yield gap keep the dollar bid and lift USDJPY even if EURUSD drifts modestly. This week we saw both dynamics: softer U.S. inflation nudged the dollar lower into Friday, but yield differentials (and Japan’s still-loose policy) supported USDJPY earlier in the week.

DXY 4 hour chart (H4)

With the dollar at the center of these cross-currents, it’s time to look more closely at how each pair — EURUSD and USDJPY — is positioning within this broader narrative.

🇪🇺EUR/USD — Waiting on the Dollar’s Next Move

EURUSD traded in a tight range around ~1.16, ending the week slightly softer after a muted reaction to European data and an absence of fresh ECB easing. The euro’s trajectory was less about sudden euro strength and more about the dollar’s ebb and flow as U.S. data and Fed commentary set the agenda.

ECB communication and recent staff projections signal a comfortable view on inflation and a bias to hold — leaving the euro without a fresh bullish catalyst while the dollar’s direction became driven by Fed expectations. That combination produced consolidation (towards the end of the week) rather than decisive directional moves.

EURUSD 4 hour chart

Market implication:

Short-term bias: neutral–bearish into any FOMC surprise that further weakens the dollar; watch a bounce in U.S. yields or hawkish surprises which would re-press EURUSD.

Key levels to watch this week: immediate support ~1.1550–1.1480, resistance ~1.1700–1.1800.

🇯🇵USD/JPY — Yield Gap Still in Control

USDJPY traded up into the low 153 area at points during the week, driven by continued yen weakness, a still-loose BoJ stance, and U.S.–Japan yield differentials. The pair was also sensitive to risk flows and any headlines around FX intervention risk.

With Japan’s policy framework still looser than the U.S., even modest U.S. rate strength or risk-on flows can push USDJPY higher. Conversely, if the Fed actually cuts (or signals a larger easing path) and U.S. yields compress, USDJPY would face downside pressure as the yield gap narrows. Expect authorities to stay verbally active — they’ve previously warned about “speculative” moves — which keeps intervention risk an ever-present tail.

USDJPY 4 Hour Chart

Market implication:

Short-term bias: structurally bullish for USDJPY while the BoJ remains looser, but event-risk sensitive (FOMC + US yields + any Japanese verbal/actual intervention).

Key levels: support ~150.00–149.00; resistance ~153.00–155.00.

🗞️Macro drivers & event slate — What we expect this week

FOMC meeting / statement & press conference: 28–29 Oct (main event)

Market consensus is pricing a 25bp Fed cut at this FOMC (probable move to 3.75–4.00% range). That expectation was reinforced by softer employment signals and the undershoot in CPI on 24 Oct. If the Fed cuts as expected (and signals more easing), the dollar will likely come under renewed pressure, benefiting EURUSD and pressuring USDJPY — though the latter depends on the reaction of U.S. yields vs. Japan. If the Fed delays or signals a smaller easing path, the dollar could re-strengthen quickly.

ECB (European Central Bank) meeting — 30 Oct

The ECB is expected to hold rates (market and central-bank messaging point to no immediate move), which means the euro will not receive a policy surprise to counter a weaker dollar. That gives EURUSD room to rally if the Fed cuts, but also leaves the euro exposed if risk sentiment turns.

Japan / BoJ commentary & intervention risk

BoJ policy remains loose relative to the U.S.; officials will likely continue to talk down sudden yen weakness. Intervention is a low-probability but high-impact tail — keep an eye on quick spikes and official comments.

Other headlines & data ⚠️

Any surprises in US employment, core inflation prints, or fresh geopolitical headlines (risk-on/risk-off) will amplify moves. Also track U.S. Treasury supply headlines and real-time moves in rate expectations (Fed funds futures).

📋Trading checklist for the week

Event risk sizing: reduce size into FOMC; prefer execution after the initial knee-jerk (or use options to define risk).

Correlated monitoring: watch DXY, EURUSD, USDJPY in that order — the DXY’s reaction will shape both pairs.

If Fed cuts 25bp (base case): expect a weaker dollar — look for EURUSD pullbacks to buy into structural resistance flips; for USDJPY, expect an initial drop unless U.S. yields remain elevated.

If Fed delays / surprises to the hawkish side: dollar strength likely — EURUSD faces downside risk; USDJPY risk of pushing to new highs; consider short EURUSD and long USDJPY approaches with tight stops.

Watch BoJ / Ministry comments: any hint of intervention changes the risk profile immediately — tighten risk controls around fast moves.

This week markets entered Fed-cut season: soft U.S. prints and Powell’s messaging have priced a near-term cut, setting up a potentially weaker dollar into the Oct 28–29 FOMC. How EURUSD and USDJPY respond will be decided by the magnitude of U.S. yield changes and BoJ/ECB messaging — trade light into the event and let yields guide directional conviction.

With currencies now positioned around key inflection points, attention turns to the E-mini Nasdaq, where shifting rate expectations and liquidity flows are already shaping the broader risk landscape.

📈Nasdaq Awaits the Fed: Calm Before the Cut

Weekly overview (20–24 Oct 2025)

During the week of 20-24 Oct, the Nasdaq‑100 (NQ) held near ~25,300-25,500 territory as markets awaited key signals on policy and tech earnings. According to CME data, the index closed at ~25,510 on 24 October. The dominant theme was the weighing of softer U.S. inflation and Fed-cut expectations against earnings and liquidity dynamics. Without a clear catalyst, the index consolidated rather than broke out.

E-mini Nasdaq Futures 4 Hour Chart

📊Macro narrative driving NQ

The expectation of a Federal Reserve rate cut remained the headline driver: a potential 25 bp cut in Oct is being priced in, which supports growth/tech exposure.

At the same time, treasury yields and real yields remain relevant — even if rates are cut, if the yield curve doesn’t compress, tech equity risk premia will still be tested.

Earnings: While major tech names continue to deliver strong numbers, commentary around forward margin pressures, slowing spending and cyclicality in cloud/AI are moderating enthusiasm.

Liquidity & sentiment: With the index near all-time highs and positioning elevated, upside room exists but risk of a pullback grows if policy or earnings disappoint.

💵Sector & flow summary

Semiconductors / AI-related names remain the “lead-off” sectors and are doing much of the heavy lifting.

Software / Cloud / Fintech stocks remain more rate-sensitive: they are vulnerable to yields backing up or Fed skipping a cut.

Capital flows: Broad index ETF flows have slowed; traders appear to be in a wait-mode ahead of the next big catalyst.

👁️🗨️What to watch for the week

FOMC meeting (28–29 Oct)

If the Fed delivers a cut and signals more ahead: strong positive backdrop for NQ; likely upside extension.

If the Fed delays or signals a more cautious path: expect a sharp but possibly short-lived pullback around 25K or above.

Key focus: Fed wording around “how far/fast” easing will go, and market interpretation of yield reaction.

Earnings season & tech commentary

With many large Nasdaq-100 components reporting or commenting, the forward guidance will matter more than the actual number.

A weaker margin outlook or spending pullback could hurt high-multiple stocks, even in a friendly rate environment.

Yield & liquidity dynamics

Watch the 10-year U.S. Treasury yield as a proxy for risk appetite. A sudden rise would weigh on growth/tech.

Any surprise in Treasury issuance, or wider macro shock, could trigger a “risk-off” rotation even if fundamental data is stable.

❗Short-term bias & Risk assessment

Base case (Fed cuts 25 bp, remains dovish):

Positive for NQ continuation upward; look for entries on pullbacks toward ~24,700-24,200 support zones, with targets into ~25,800-26,200 region.

Risk-reward favourably skewed for dip-buyers into near-term consolidation.

Monitor intra-day reactions post-FOMC; a shallow pullback followed by institutional accumulation could set up a run-higher.

Alternative case (Fed holds or signals caution):

Expect a sharper pullback. Immediate support to watch: ~24,000-23,500 zone. A break here risks a deeper correction toward ~22,500-22,000.

In that scenario, short/hedge trades become favoured; growth stocks & high multiples likely under pressure.

NQ is trading near the ~25,300 region, with the next major move hinging on the FOMC. The risk-reward remains skewed toward the upside If the Fed delivers and stays dovish. But a cautious or delayed Fed could trigger a sharp pullback — the margin for error is now slimmer as valuations are elevated.

🧪Technical Corner: Mapping the Market

With the fundamental landscape now laid out the focus turns to how these narratives are being priced in on the charts. Price often moves ahead of headlines, and this week is no exception. As markets position into the FOMC and month-end flows, technical structure will offer the clearest insight into where liquidity sits and how traders are likely to react around key zones.

In the Technical Corner, we’ll break down how each asset is responding to these macro dynamics, highlighting where price may offer opportunity, and where managing risk remains paramount.

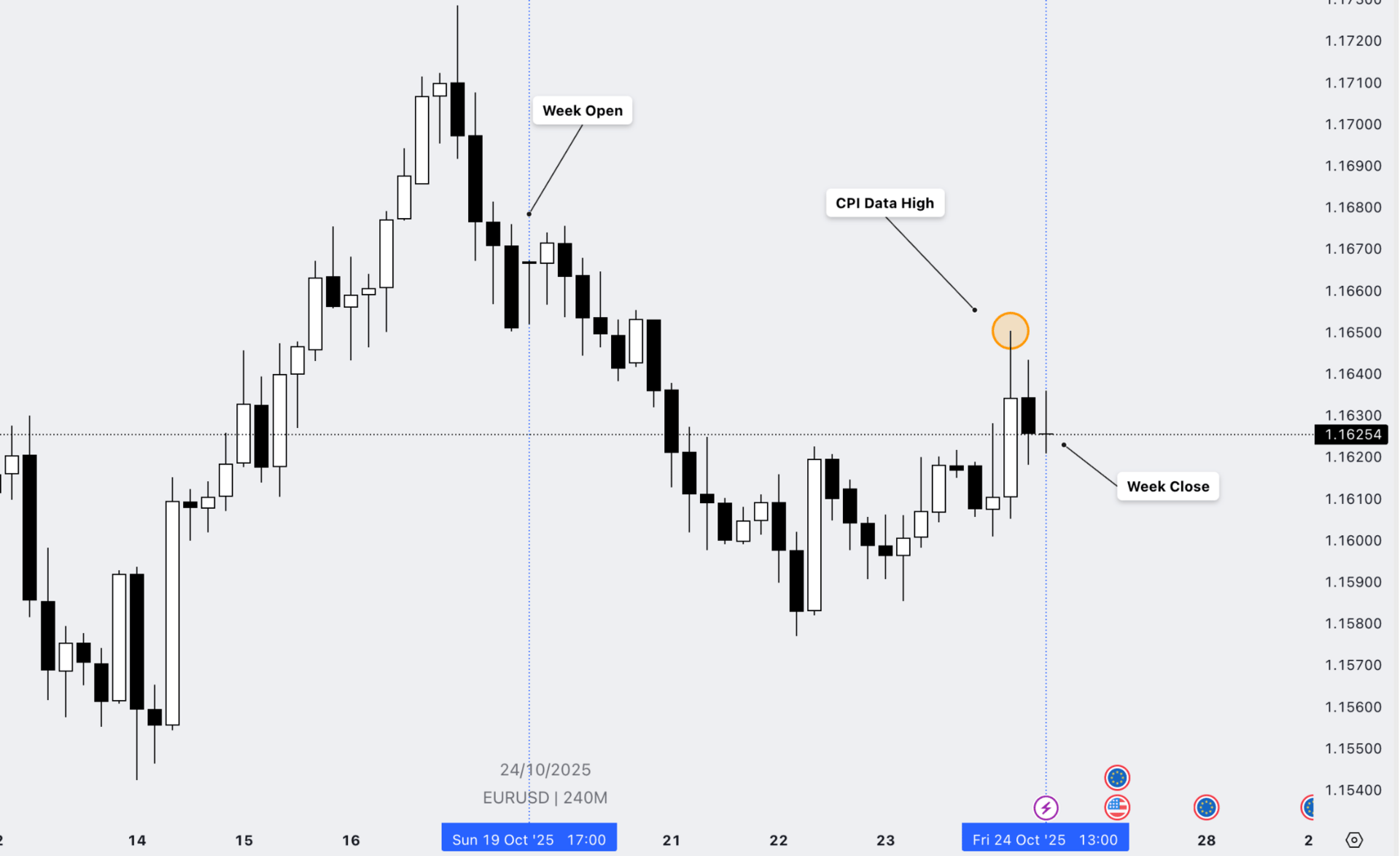

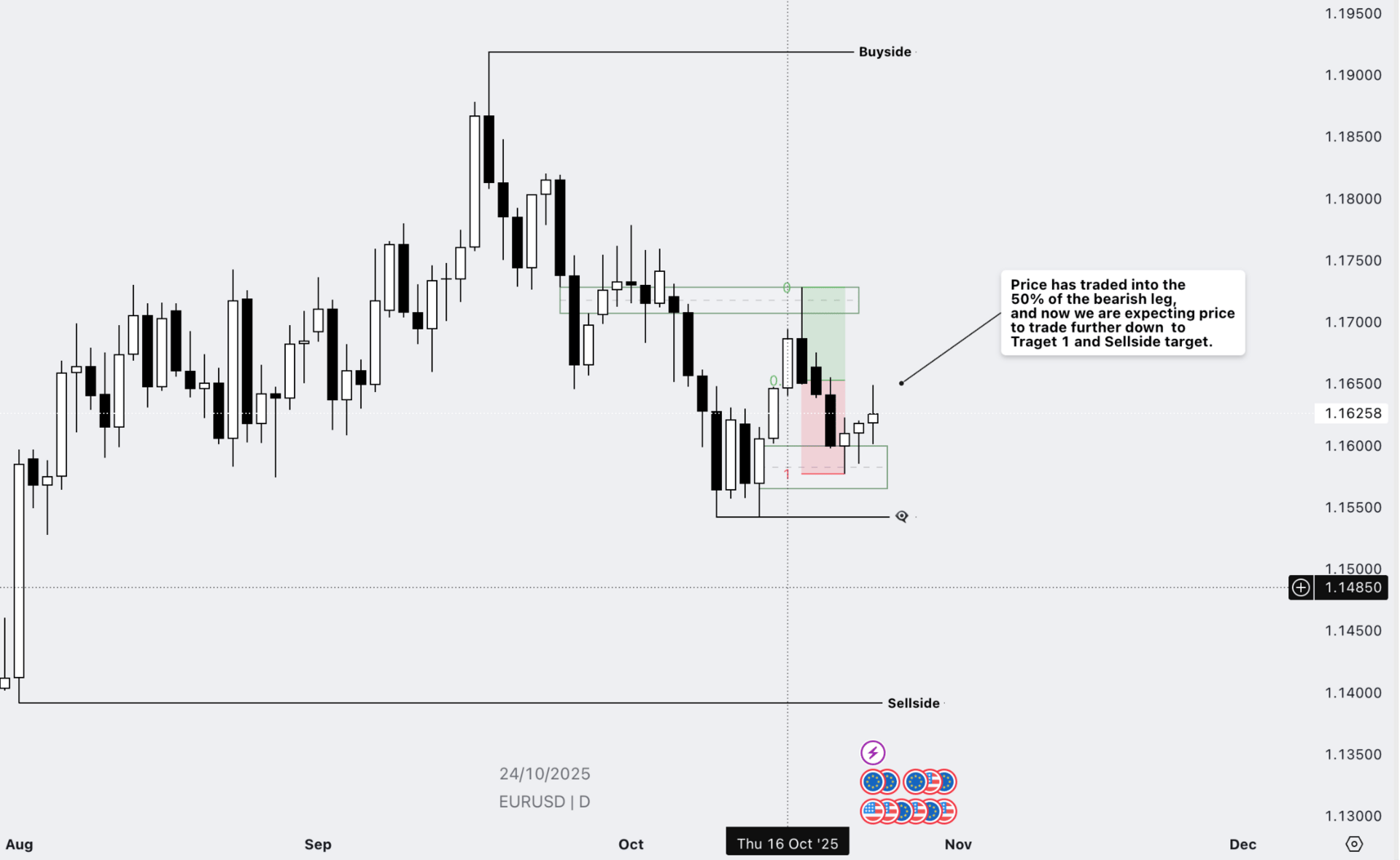

🇪🇺EURUSD

EURUSD Daily Chart

On the daily timeframe, price has traded back into the 50% equilibrium of the recent range, in line with our previous mid-week projection. With this retracement complete, we can now look for price to deliver into our first objective before reaching deeper into the sellside objective.

Lets Zoom in!

EURUSD H4 Chart

Price has rebalanced into the H4 order block sitting near the 50% equilibrium of the current bearish leg. While our directional bias remains bearish, we’re mindful of two potential outcomes:

A clean continuation toward our initial downside objective, or

A short-term reaction from the bullish FVG that could provide temporary support.

Our focus remains on the first scenario, but we’ll be observing the FVG closely to gauge whether price begins accumulating and signals a shift in momentum.

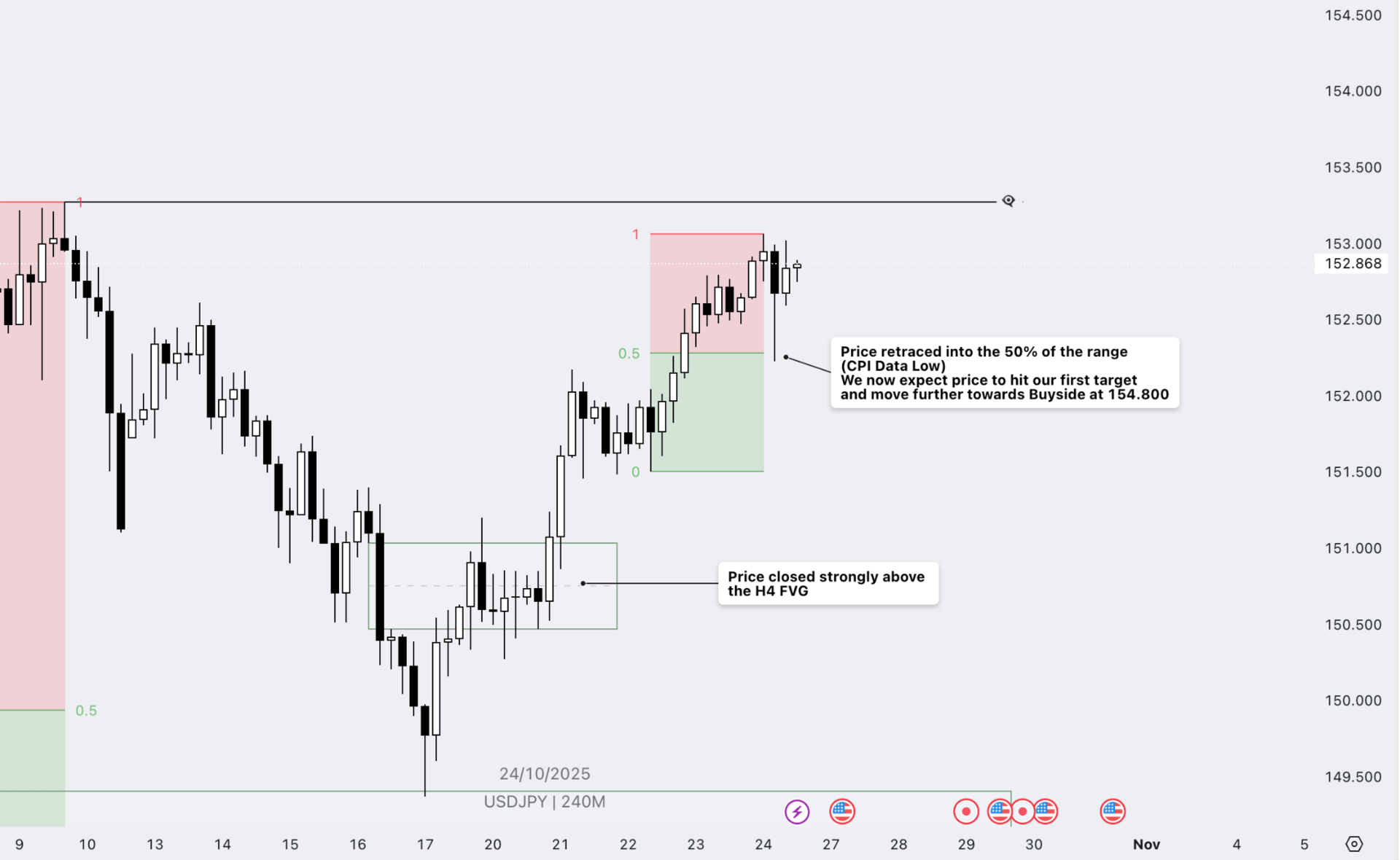

🇯🇵USDJPY

USDJPY Daily Chart

Price has unfolded exactly in line with our last week’s analysis. After retracing into the 50% level of the recent bullish leg, USDJPY found support and resumed its upward momentum which also confirms our mid-week projection, expecting a clean continuation into our first objective.

As long as structure holds, price is expected to extend further toward the buyside liquidity target, completing the broader bullish move outlined in our earlier analysis.

Lets Zoom in!

USDJPY H4 Chart

On the H4 chart, price has reacted precisely as anticipated following the CPI release. The move validated our midweek outlook, showing how liquidity was engineered before continuation. Key observations include:

CPI-driven retracement into the 50% equilibrium completed.

Price reacted with strong bullish momentum.

Expect continuation toward key upside targets:

Target 1: ~153.300

Target 2: ~154.800

🟢E-mini Nasdaq Futures

E-Mini NQ1

Price action on NQ continues bullish momentum, trading near all-time highs and showing no signs of reversal. At these levels, we’re not looking for shorts; instead, our focus remains on potential long opportunities as price seeks higher targets.

From current structure, we have two possible bullish scenarios:

Scenario 1: Price reacts to the nearby Fair Value Gap (FVG), maintaining strength and pushing higher toward the 25,600–25,800 region.

Scenario 2: Price trades slightly deeper, filling the lower FVG around the 50% equilibrium of the range before resuming its bullish continuation.

Both setups remain in line with our broader expectation of a rate cut and continuation into higher liquidity zones as long as structure holds firm.

We’ll reassess this setup and provide updated guidance in our mid-week Technical Corner, this wednesday at 18:00 EST.

Final Word

As we close out this week’s analysis, one theme ties all markets together — reaction over prediction.

The dollar’s direction remains at the core of global flows: EURUSD continues to mirror shifting Fed expectations, USDJPY rides the yield gap and intervention risk, DXY reflects the broader dollar tone, and NQ moves in step with liquidity and rate repricing. Each chart tells the same story — the market is waiting for confirmation from the Fed before committing to its next leg.

In times like these, patience is not just a virtue — it’s a strategy. The setups are forming, liquidity is building, and next week’s FOMC will provide the clarity needed for the next decisive move. Until then, trade lightly, manage risk, and focus on reaction — not prediction.

The goal is not to predict the future, but to prepare for it.

Stay disciplined, stay adaptive, and we’ll be back midweek with updated insights in the Technical Corner.

Until then, Happy Trading! 👁️🗨️

© 2025 UE Market Letter. All rights reserved.

The information shared in the UE Market Letter is intended solely for educational and informational purposes. It should not be interpreted as financial, investment, or trading advice. All views expressed reflect the author’s personal analysis and opinions and are not recommendations to buy, sell, or hold any financial instrument. Trading and investing carry inherent risks and may not be suitable for every investor. Market performance is uncertain — past results do not guarantee future outcomes. Readers are encouraged to conduct their own research and seek guidance from a licensed financial advisor before making any investment decisions. UE Market Letter and its authors accept no liability for any loss or damage arising from reliance on the content provided.