The final week of October (Oct 27–31, 2025) revolved around the Federal Reserve, a rate cut, and a cloud of policy uncertainty colliding with the ongoing U.S. government shutdown. The Fed delivered a 25 bps cut to 3.75–4.00%, but its hawkish tone curbed expectations for further easing. With official data frozen and sentiment fragile, traders looked to yields, Fed commentary, and price action for direction.

This set the tone across markets. The dollar’s reaction became the key driver — shaping moves in EURUSD and USDJPY, while the broader risk backdrop steered equities like the Nasdaq 100.

In this week’s fundamentals, we break down how each market responded to the Fed’s “hawkish cut,” and what to watch in the week ahead (Nov 3–7) as the shutdown and NFP uncertainty continue to dominate sentiment.

🇪🇺 EURUSD — Pressured as the Dollar Holds Ground

EURUSD drifted lower through the week as the Fed’s message recalibrated the rate-cut narrative. The ECB remained in the background with no major releases, leaving the euro at the mercy of dollar dynamics.

The rate cut, paradoxically, strengthened the USD—because Powell’s tone was firm, emphasizing data dependency and not pre-committing to more easing. That hawkish undertone lifted yields and revived dollar demand.

The Eurozone side offered little resistance: growth data remained subdued, and inflation moderation kept the ECB comfortably sidelined.

EURUSD faded back toward recent lows near 1.165 – 1.17 as the dollar regained footing.

EURUSD Hourly Chart (Weekly Projection)

🇯🇵 USDJPY — Yield Differentials Still Dominate

What happened: USDJPY traded higher, brushing the 153.8 – 154.0 zone, driven by persistent yield spreads. The Bank of Japan stayed dovish, sticking to its ultra-loose stance and verbal interventions to “monitor speculative moves.”

U.S. yields’ slight uptick post-FOMC widened the U.S.–Japan differential again, encouraging another leg up.

However, officials’ rhetoric reminded traders that intervention risk lurks near 155, introducing short-term hesitation.

USDJPY Hourly Chart (Weekly Projection)

💵 One Dollar Two Stories

The Fed’s 25 bp cut didn’t weaken the dollar; it re-anchored it.

Why? Because with the government shutdown freezing fresh macro data (NFP, CPI, GDP revisions), the only guidance left is policy tone and yields.

Powell’s signal — “further cuts are not guaranteed” — told markets that the easing cycle might pause if inflation data (whenever it reappears) doesn’t roll over fast enough.

That pushed the Dollar Index (DXY) modestly higher, putting EURUSD under pressure and keeping USDJPY supported.

The euro and yen, both tethered to more dovish central banks, have limited upside when the Fed’s tone is less dovish than expected. Hence, despite a U.S. rate cut, the dollar paradoxically strengthened — a classic “hawkish cut”dynamic.

Dollar Index (DXY) Hourly Chart (Weekly Projection)

🔭 The Week Ahead: Nov 3rd – 7th, 2025

Government Shutdown: The wildcard. If it extends, markets continue flying blind; if resolved, data releases resume, possibly triggering volatility as traders recalibrate expectations.

ISM Services (Wed 5 Nov): In the absence of jobs data, this becomes the main gauge of U.S. momentum. A strong print supports USD; a soft one could finally pressure it.

NFP Friday (7 Nov): Still uncertain — may be postponed. If it goes ahead and surprises strong, it reinforces the “hawkish cut” logic; a weak number could be the first real crack in the dollar’s armor.

BoE meeting (Thu 6 Nov): GBP drivers could indirectly affect EUR via cross-flows — another layer of volatility for European FX.

The dollar remains the axis — firm enough to cap EURUSD and keep USDJPY near highs, yet vulnerable if the shutdown lifts and softer data returns.

For now, fundamentals keep bias bullish-USD, bearish-EURUSD, and bullish-USDJPY, until policy clarity or data flow resets expectations.

The key phrase for the week: “Hawkish cut, data blackout.”

📊 NQ — Between Euphoria and Exhaustion

After weeks of optimism driven by dovish expectations, the Nasdaq 100 entered a critical balancing phase between rate-cut euphoria and economic reality.

The final week of October (Oct 27–31 2025) was defined by the Fed’s second rate cut of the year, a still-active government shutdown, and fading tech momentum as traders began questioning how much good news was already priced in.

🗞️What Happened (Oct 27 – 31 2025)

The Fed cut 25 bps to 3.75 – 4.00 %, but Powell’s statement cooled expectations for rapid easing.

→ The initial risk-on reaction faded quickly as markets realised this was a “hawkish cut”, not a green light for a full pivot.Big Tech earnings were mixed: strength in semiconductors and AI-linked names offset by cautious guidance from cloud and consumer-discretionary giants. The results underlined that valuations remain stretched.

The government shutdown left key macro data unavailable, adding uncertainty around demand trends and earnings visibility.

Yields stabilised, preventing a full-scale equity sell-off, but the NQ’s upside momentum stalled near the 25,200–25,400 zone as traders digested both the Fed message and weaker breadth across the index.

Nasdaq Futures Hourly Chart (Weekly Projection)

📰Macro Narrative: When Liquidity Meets Uncertainty

The Fed’s actions were supposed to be stimulative, yet the tone suggested caution.

That paradox rippled through equities:

Rate cuts support valuations, but hawkish language reduces the pace of liquidity expansion investors crave.

With the shutdown freezing data, the market’s imagination filled the gaps — some see resilience, others fear a slow-motion slowdown hidden behind missing numbers.

Meanwhile, AI enthusiasm remains, but leadership is narrowing: mega-caps carry the index while cyclical tech and small caps lag, hinting at exhaustion under the surface.

In short, the NQ is caught between liquidity hopes and macro fog — still bullish in structure, but showing signs of fatigue.

🎙️The Week Ahead (Nov 3 – 7 2025)

Shutdown & Data Watch: If Washington strikes a deal early week, expect a burst of volatility as delayed releases (especially NFP) hit at once. If not, uncertainty keeps risk appetite capped.

ISM Services (Wed): Key gauge for demand — a strong reading could revive yields and pressure equities, while a weak print might trigger another short-term relief rally.

NFP Friday (Nov 7): Still uncertain; if released and beats expectations, markets may start fearing a pause in cuts— bearish for tech. A weak print, however, would reinforce the soft-landing narrative and support NQ near-term.

The Nasdaq 100 remains technically supported but fundamentally uneasy.

Rate cuts have created a cushion, yet the hawkish tone, data blackout, and stretched valuations keep upside limited.

Heading into the first week of November, expect sideways-to-slightly-bullish bias — unless the shutdown ends and data surprises hawkish, which could quickly flip sentiment.

👉 For now, this is a “trade the reaction, not the prediction” market — liquidity’s still here, but conviction isn’t.

🧪The Technical Corner

With the macro backdrop set — a hawkish Fed cut, an ongoing government shutdown, and markets caught between policy uncertainty and data scarcity — it’s time to let price tell the rest of the story. Fundamentals give us the narrative, but the Technical Corner sharpens the execution.

We’ll now turn to the charts to see how these broader themes are translating into price action — identifying key areas of interest, momentum shifts, and potential zones where market behavior may set up the next move across major assets.

Let’s break down the setups — starting with EURUSD, USDJPY, and then moving to NQ for a deeper look at where momentum could shift in the days ahead.

🇪🇺 EURUSD

EURUSD followed last week’s bearish outlook, retracing to the 50% equilibrium before turning lower.

EURUSD Daily Chart

Price is now around 1.1530, sitting inside a Daily FVG and key support zone (1.1450–1.1400).

This area is critical:

A break lower confirms continuation toward 1.1400.

A strong reaction here could trigger a short-term retracement.

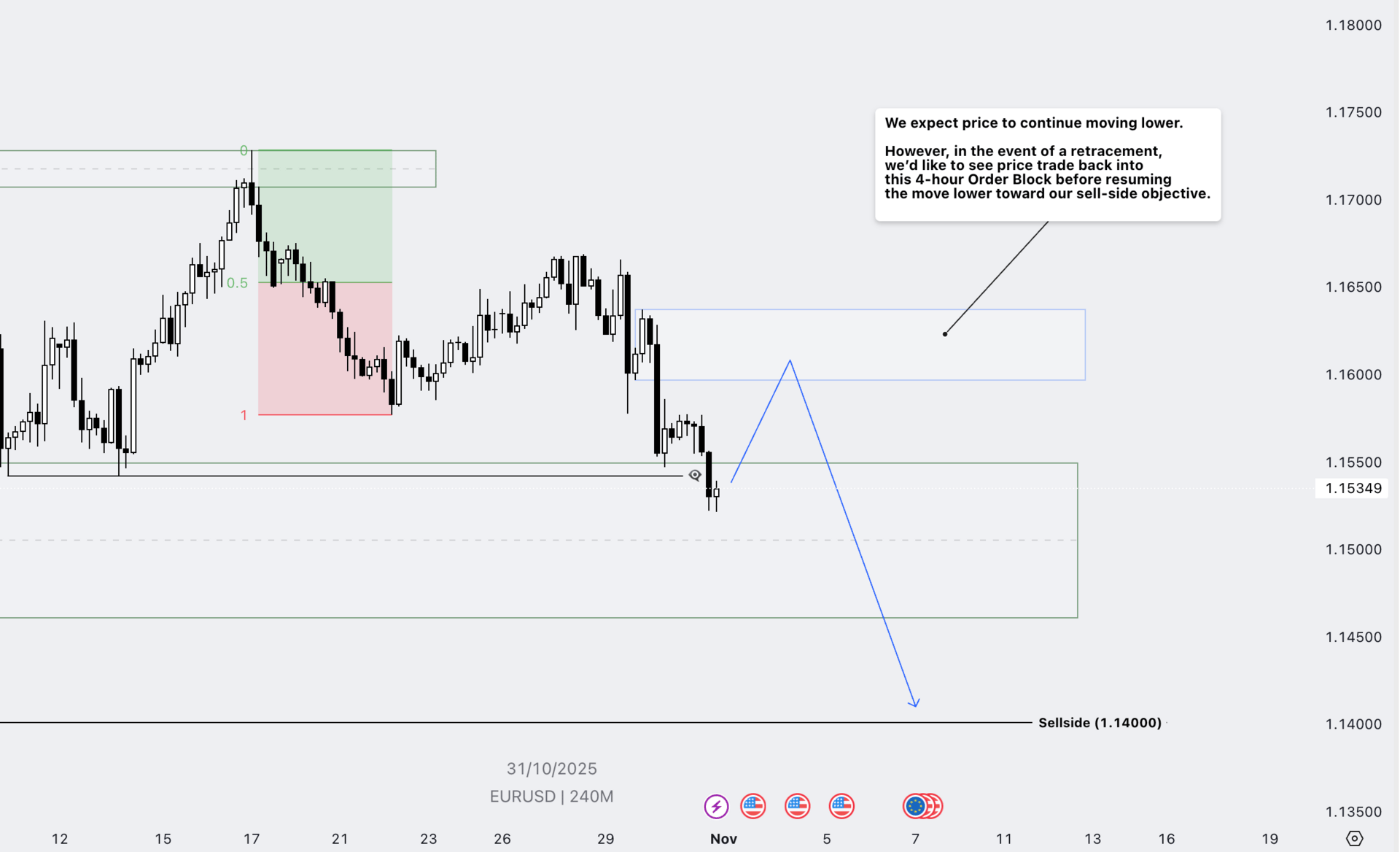

EURUSD H4

On the 4 Hour timeframe, EURUSD maintains a clear bearish structure, aligning with our broader downside bias.

We expect a continued move lower toward the 1.1400 sell-side objective.

If a short-term retracement occurs, watch the 1.1600–1.1650 zone (prior 4H Order Block) for potential rejection.

This area is ideal for confirming bearish continuation if price reacts lower.

Overall, structure and reaction zones remain consistent with our analysis, supporting further downside after any brief pullback.

🇯🇵 USDJPY

Price action remains firmly bullish, continuing to respect the directional bias highlighted in our previous analysis.

USDJPY Daily Chart

After clearing liquidity above 154.00, price is now targeting the Daily Order Block at 157.50–158.00.

This zone may trigger a pause or short-term reversal, especially amid intervention risks.

Until then, structure remains constructive to the upside, supported by strong yield differentials and dollar demand.

Base case: a push toward ≈158.00, followed by consolidation or a corrective pullback depending on reaction at that level.

USDJPY H4 Chart

USDJPY hit our first upside objective, confirming last week’s bullish continuation.

Price is now consolidating below 154.80, a key buyside target and reaction zone.

Short-term retracement expected toward the 153.40–153.60 area (≈50% of the current bullish leg).

As long as price holds above 153.00, structure remains bullish.

A sustained close above 154.80 could trigger an extended rally toward higher objectives.

📊NASDAQ Futures (NQ)

Price continues to respect the bullish structure, following the same broader outlook shared in last week’s analysis.

NQ H4 Chart

After hitting 26,400, price is now pulling back within the current range.

We expect a retracement into the 25,400–25,600 zone — the 50% equilibrium and prior demand area.

From this zone, watch for signs of renewed bullish momentum toward buyside targets above 26,400.

As long as price stays above 25,200, the broader bias remains bullish, with dips seen as continuation opportunities.

Overall, NQ is consolidating before a potential move higher, supported by both fundamentals and structure.

NQ H1 Chart

On the H1

NQ is retracing after last week’s strong bullish move, in line with prior analysis.

Watching the New Week Opening Gap (25,500–25,600) for potential long setups.

Plan: look for buying opportunities in this zone, targeting 26,100–26,400.

Structure remains bullish, with the pullback viewed as a healthy correction within the uptrend.

As long as price holds above 25,400, bias stays bullish toward buyside targets.

Overall, price action continues to respect our levels and roadmap, confirming the outlook.

🧩 Final Word

This week’s price action continues to validate our broader market framework — where policy signals, data uncertainty, and technical structure remain tightly intertwined.

The dollar’s resilience following the Fed’s “hawkish cut” has shaped much of the landscape:

EURUSD remains pressured, respecting our bearish bias as price continues to draw lower within its broader range.

USDJPY extended higher, reaching key upside objectives with the potential to test the Daily Order Block near 157–158 before any meaningful reversal develops.

NQ (Nasdaq 100) is consolidating after a strong run-up, holding bullish structure while retracing into key demand zones — a healthy setup for potential continuation higher if risk appetite holds.

Overall, the picture remains data-dependent and policy-driven. The unresolved U.S. government shutdown keeps markets reactive, while upcoming events like ISM Services and a possible NFP release could trigger directional conviction. Until then, volatility around these zones is likely to persist.

From a structural standpoint, each market continues to move in line with our previous analysis — the dollar’s strength guiding EURUSD lower, supporting USDJPY, and keeping equity upside measured but intact. As we move into the new week, it’s crucial to stay adaptable: let data and price confirm your bias, not override it. The next major catalysts will come from Washington’s shutdown developments and the Fed’s policy path ahead — trade accordingly, manage risk, and let structure lead.

The goal is not to predict the future, but to prepare for it

Stay safe, and happy trading. 👁️🗨️

— The UE Market Letter Team

© 2025 UE Market Letter. All rights reserved.

The information shared in the UE Market Letter is intended solely for educational and informational purposes. It should not be interpreted as financial, investment, or trading advice. All views expressed reflect the author’s personal analysis and opinions and are not recommendations to buy, sell, or hold any financial instrument. Trading and investing carry inherent risks and may not be suitable for every investor. Market performance is uncertain — past results do not guarantee future outcomes. Readers are encouraged to conduct their own research and seek guidance from a licensed financial advisor before making any investment decisions. UE Market Letter and its authors accept no liability for any loss or damage arising from reliance on the content provided.