The week of 2nd – 8th November 2025 kept the U.S. dollar at the centre of the global market story, as the fifth week of the government shutdown deepened uncertainty and froze key data releases. With traders flying blind, markets leaned heavily on policy tone, yields, and risk sentiment for direction.

Against this backdrop, major assets — EUR/USD, USD/JPY, and Gold (XAU/USD) — all moved in rhythm with the dollar’s behaviour: when USD strength re-emerged, the euro slipped, yen softened, and gold retreated; when the dollar cooled amid funding stress or political tension, the reverse unfolded, with the euro and gold catching brief relief while USD/JPY consolidated.

Dollar Hourly Chart Weekly Projection (02/11/25 - 07/11/25)

With the macro stage defined, we can now break down how these forces shaped individual markets. From the euro’s struggle against a firm dollar, to yen moves anchored by yield spreads, and gold’s balance between safety and strength — each tells a part of the same story.

We now break down how EUR/USD, USD/JPY, and Gold navigated last week’s volatility — and what their next moves may reveal as we enter the new week.

🇪🇺 EUR/USD — Pressured Beneath the Data Fog

The euro remained on the defensive as the dollar’s resilience dominated FX flows. With the ECB sidelined and euro-area data offering little pushback, EUR/USD drifted lower toward the 1.14600 region (closing slightly higher) , mirroring last week’s tone.

EURUSD Hourly Chart Weekly Projection (02/11/25 - 07/11/25)

Hawkish Fed tone + shutdown uncertainty = fewer reasons to sell the dollar.

The euro’s muted growth outlook and steady inflation moderation kept the ECB out of play, further reinforcing the imbalance.

Whenever shutdown worries spurred safe-haven flows into Treasuries, EUR/USD found shallow rebounds, but these were more about temporary dollar dips than euro strength.

🇯🇵 USD/JPY — Yield Differentials Keep the Engine Running

If the euro was weighed down by the dollar, USD/JPY was lifted by it. The pair hovered in the 153.6–154.0 zone, continuing to respect bullish structure as U.S.–Japan yield spreads stayed wide.

USDJPY Hourly Chart Weekly Projection (02/11/25 - 07/11/25)

The Bank of Japan’s dovish stance and its pledge to “monitor speculative moves” provided verbal caution, but little material change.

The shutdown’s uncertainty didn’t dent carry appetite — traders still preferred dollar-denominated yield.

The result: while the dollar powered higher against the euro, it consolidated against the yen — staying firm but cautious near potential intervention levels (Potential 155.00).

🟨 Gold (XAU/USD) — Tug of War Between Dollar Strength and Safe-Haven Demand

Gold spent the week oscillating around the $4,000 zone, caught between two opposing forces:

Dollar strength and firmer yields limited upside.

Shutdown-induced uncertainty offered periodic safe-haven support.

Gold (XAUUSD) Hourly Chart Weekly Projection (02/11/25 - 07/11/25)

The net effect was consolidation, not breakout — a sign that the metal remains hostage to the same dollar dynamics moving major FX pairs. When the dollar strengthened on hawkish policy tone, gold retreated; when shutdown angst hit confidence, gold regained a modest bid.

In short, the dollar continued to dictate cross-asset tone:

Its resilience capped EUR/USD,

Propped USD/JPY, and

Tempered Gold’s rally, showing just how tightly all three assets remain tied to the greenback’s policy-driven rhythm.

🔭 The Week Ahead: Nov 10 – 14 2025

Markets now enter another uncertain week dominated by two potential catalysts — the status of the government shutdown and the upcoming U.S. CPI release.

Shutdown Watch:

If Washington reaches a deal early in the week, expect a rush of delayed data (including NFP rescheduling) that could jolt volatility.

If the impasse continues, the “data blackout” theme extends, keeping policy expectations speculative and liquidity uneven.

CPI Day (Thursday 13th Nov):

A hotter-than-expected CPI would re-energize the dollar, pushing EUR/USD lower, USD/JPY higher, and likely weighing on Gold.

A softer CPI could trigger the opposite — weaker dollar, short-term euro relief, yen recovery, and a bid for bullion.

Yields & Fed Speak:

Any shift in Treasury yields or hawkish remarks could reignite the “hawkish cut” narrative, favouring the dollar.

Conversely, dovish tones or hints of fiscal stress might cool the dollar’s advance.

Until data clarity returns, the dollar remains the axis around which global markets orbit. Expect EUR/USD to stay pressured, USD/JPY to hold firm near highs, and Gold to trade sideways with a safe-haven floor. In this environment, conviction remains low — and adaptability remains the trader’s edge.

📊Nasdaq-100 Futures (NQ) - Between Resilience and Reality

The Nasdaq 100 spent the week of Nov 2nd – 8th 2025 caught between liquidity hopes and valuation fatigue. With the U.S. government shutdown stretching into its fifth week and official data frozen, traders were left to trade policy tone, yields, and headlines.

Early gains faded mid-week as tech sentiment cooled, especially in the AI and semiconductor space. The Fed’s “hawkish cut” narrative — signaling caution despite easing — kept yields firm and the dollar strong, a combination that weighed on rate-sensitive growth stocks.

NQ Futures Hourly Chart Weekly Projection (02/11/25 - 07/11/25)

While the broader structure remains bullish, momentum clearly slowed. The shutdown’s data blackout drained conviction, leaving NQ oscillating within range as markets awaited clarity from Washington and the inflation front.

🔭 The Week Ahead (Nov 10 – 14 2025)

All eyes now turn to CPI Day and any breakthrough on the shutdown stalemate.

A hot CPI could revive yields and pressure NQ.

A softer print or fiscal resolution may ease dollar strength, allowing a short-term equity rebound.

Until then, expect sideways-to-slightly-bullish trade, with buyers defending key support near 25,000 –24,800 and sellers likely re-emerging toward 26,400. Liquidity remains the driver — conviction will only return once data does.

🧪The Technical Corner

With the macro picture set, it’s time to let price action speak. Fundamentals shaped sentiment — now structure reveals intent. In this week’s Technical Corner, we focus on key levels and momentum across EUR/USD, USD/JPY, Gold, and NQ to refine the roadmap ahead.

Let us dive into the charts!

🇪🇺 EURUSD

EURUSD Daily Chart

Price has reacted exactly as outlined in our prior analysis. After retracing into the 50% equilibrium of the current bearish leg, EUR/USD met resistance and began turning lower — a clean rejection consistent with our broader downside bias.

Bearish structure remains bearish, with price reacting from the premium zone (~1.1650).

The rejection from the 50% level confirms continued sell-side control.

Retracement phase likely complete — price now expected to draw toward 1.1400 liquidity.

Unless price breaks and holds above 1.1650, bias stays bearish.

EURUSD H4 Chart

Zooming in on the H4:

Price is currently retracing after last week’s drop, trading just below a bearish Order Block (OB) around 1.1600–1.1650.

We may see a retest of this zone early in the week before continuation lower.

Ideally, price taps into the OB and rejects sharply, confirming potential entry or re-entry in line with the higher-timeframe bearish bias.

As long as price remains below 1.1650, structure favors a move toward the Sellside target at 1.1400.

Our Bias: Bearish — targeting 1.1400

🇯🇵 USDJPY

Price action on USD/JPY has now followed our broader outlook for five consecutive weeks, respecting structure and each key level highlighted in prior analyses. The pair continues to move in line with our bullish roadmap — reacting cleanly from demand zones and progressing toward our projected upside targets.

USDJPY Daily Chart

Price reacted cleanly from the bullish Order Block (OB) and continues to respect overall bullish structure.

We now expect price to draw toward the Buyside target at 154.80, and potentially extend into the Daily OB near 157.50–158.00.

That zone marks a key area for potential reversal or deeper correction, especially if intervention risks re-emerge.

As long as price holds above 152.00, bias remains bullish toward the upper objectives.

USDJPY H4 Chart

Zooming in on the H4:

Price continues to respect our bullish framework, reacting cleanly from the 4H Order Block near 153.00.

A strong body close above the Fair Value Gap (FVG) would confirm bullish continuation toward the Buyside target at 154.80.

Momentum remains constructive, with the Daily OB around 157.50–158.00 still serving as the higher-timeframe objective.

As long as price holds above 152.80, structure stays bullish.

Our Bias: Bullish – Targeting 154.80, then 157.50–158.00

🟨XAUUSD

This marks our first Gold feature in the Technical Corner — and it enters at a decisive point. After months of strong bullish momentum, XAU/USD has begun to show signs of exhaustion, reacting precisely from a bearish Fair Value Gap (FVG) that now acts as resistance.

XAUUSD Daily Chart

The bearish Fair Value Gap (FVG) continues to hold as resistance, keeping structure tilted to the downside.

Price is struggling to break above the $4,050 zone, confirming that sellers remain active within the imbalance.

We expect price to draw lower into the 50% level of the prior bullish leg — around $3,800–$3,850 — and potentially extend toward the $3,400 key support zone.

As long as price trades below $4,100, the short-term bias remains bearish.

Zooming into the H4:

XAUUSD H4 Chart

Price remains capped by the Daily Fair Value Gap (FVG), showing hesitation to break higher.

Two scenarios are in play:

Scenario 1: Price retraces into the 50% level of the current bearish leg before resuming lower.

Scenario 2: Price continues its selloff directly from the current FVG, confirming continued bearish pressure.

In both cases, structure favors the downside while price trades below $4,100.

Our Bias: Bearish – Expecting continuation toward $3,850, possibly lower if FVG holds.

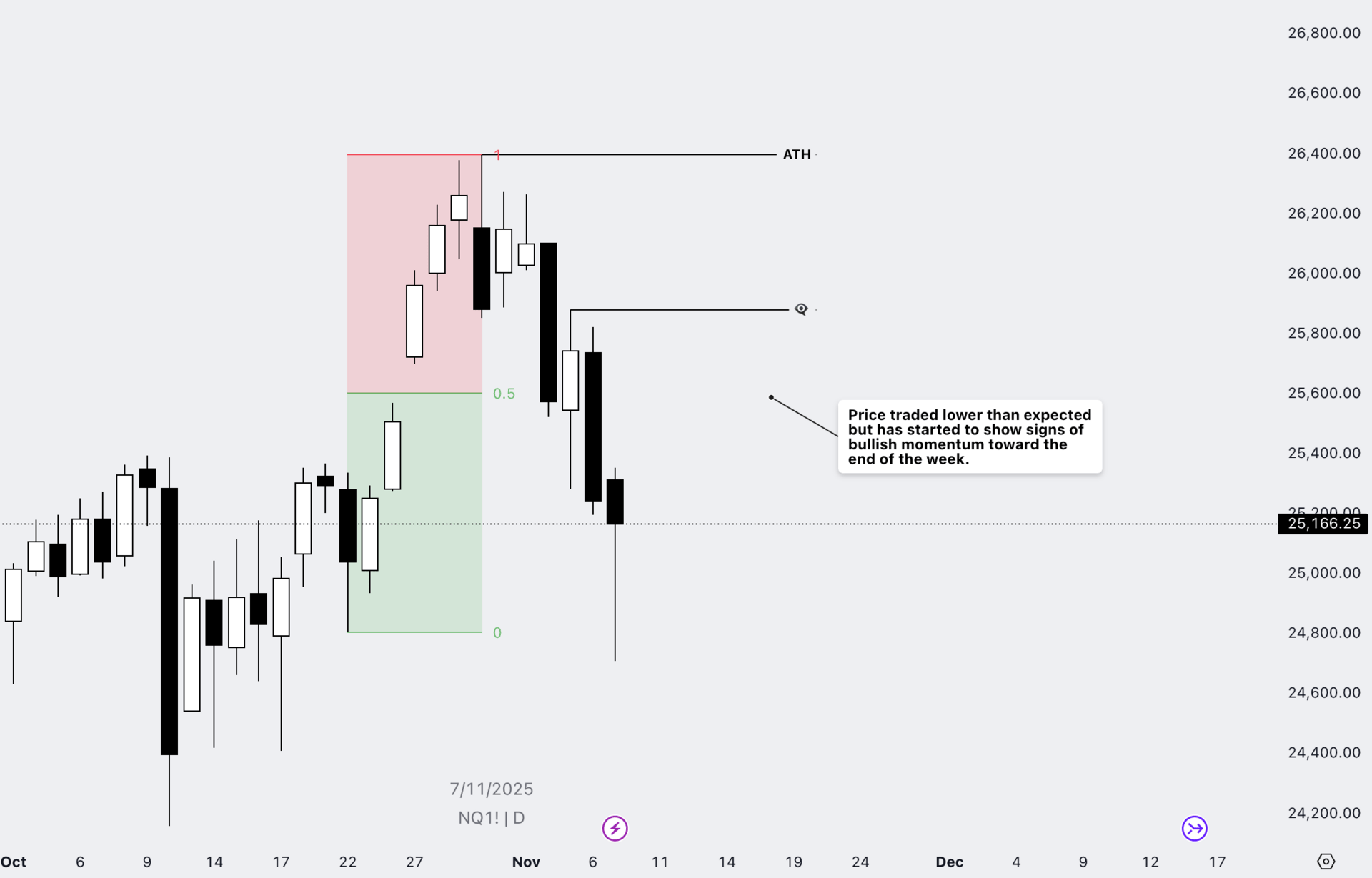

📊NASDAQ Futures (NQ)

Price traded lower than we anticipated in last week’s analysis, dipping deeper into the retracement zone before finding support near the 25,100–25,200 area. Toward the end of the week, momentum began to shift, hinting at potential recovery.

NQ Daily Chart

The pullback respected the 50% level of the prior bullish leg, aligning with our projected retracement zone.

Late-week candles show the first signs of bullish intent, suggesting price may attempt to rebound.

If momentum holds, we could see price revisit 25,600–25,800 in the short term.

A sustained break below 25,000 would invalidate this recovery setup and open room toward deeper downside.

Zooming into the H4:

NQ H4 Chart

Price closed firmly above the 4H Fair Value Gap (FVG), signalling renewed bullish momentum heading into the new week.

Two potential scenarios stand out:

Scenario 1: Price may reach our first upside target near 25,600, then reject and resume the sell-off.

Scenario 2: Price extends beyond that target, continuing higher toward the all-time highs if momentum persists.

As long as price holds above 25,100, structure remains constructive and the bullish scenario stays valid.

Our Bias: Neutral-to-Bullish – Watching for reaction near 25,600 to confirm continuation or rejection.

🧩 Final Word

This week’s price action largely validated our broader framework — structure and sentiment remain aligned across the board.

EUR/USD continued to respect bearish order flow, staying heavy beneath the 1.1650 zone.

USD/JPY maintained its five-week bullish rhythm, pushing toward upper targets as yield spreads stayed wide.

Gold (XAU/USD) confirmed its first bearish setup in our coverage, holding below the FVG and hinting at further downside.

And NQ — despite early weakness — showed signs of recovery, with structure still supportive above key demand levels.

As markets move through November, uncertainty around the shutdown, yields, and CPI remains the dominant catalyst. In times like these, conviction comes not from prediction, but from preparation — reading structure, managing risk, and adapting without emotion.

Stay focused, trade with intention, and remember: clarity comes from discipline, not noise.

Stay Safe and Happy Trading!👁️🗨️

— The UE Market Letter Team

© 2025 UE Market Letter. All rights reserved.

The information shared in the UE Market Letter is intended solely for educational and informational purposes. It should not be interpreted as financial, investment, or trading advice. All views expressed reflect the author’s personal analysis and opinions and are not recommendations to buy, sell, or hold any financial instrument. Trading and investing carry inherent risks and may not be suitable for every investor. Market performance is uncertain — past results do not guarantee future outcomes. Readers are encouraged to conduct their own research and seek guidance from a licensed financial advisor before making any investment decisions. UE Market Letter and its authors accept no liability for any loss or damage arising from reliance on the content provided.